The Nothingness of Money

When I was in junior high school, I heard a riddle that blew my mind.

It went something like this:

Rich people need it. Poor people have it. If you eat it, you die. And when you die, you take it with you. What is it?

Feel free to sit with the question for a moment.

Okay.

Ready?

The answer is…

Even today, this riddle puts a smile on my face. But when I first heard it, I remember being floored after hearing the answer and funneling it through each statement.

Back then, I enjoyed the riddle for its cleverness.

But today, I enjoy it for its simple profundity.

The claim that “rich people need nothing” is not a literal one, but it points to how the pursuit of money is the unifying struggle of the modern era. We can opt out of the stories of religion or politics, but we cannot opt out of the story of money. It is so interwoven into the fabric of society that even our physical health depends upon how abstract numbers on a screen can be converted into tangible meals.

At the same time, however, the riddle states another truth: Nothing passes through the great wall of death. Whether you’re a billionaire or a homeless person, everything goes to null in the face of the great equalizer. The only thing you may be able to preserve is a legacy, but that legacy is for other conscious minds to perceive, which is no longer a luxury you have upon hitting that wall.

So herein lies the Great Tension:

Money is a required pursuit for life, but a pointless pursuit upon death.

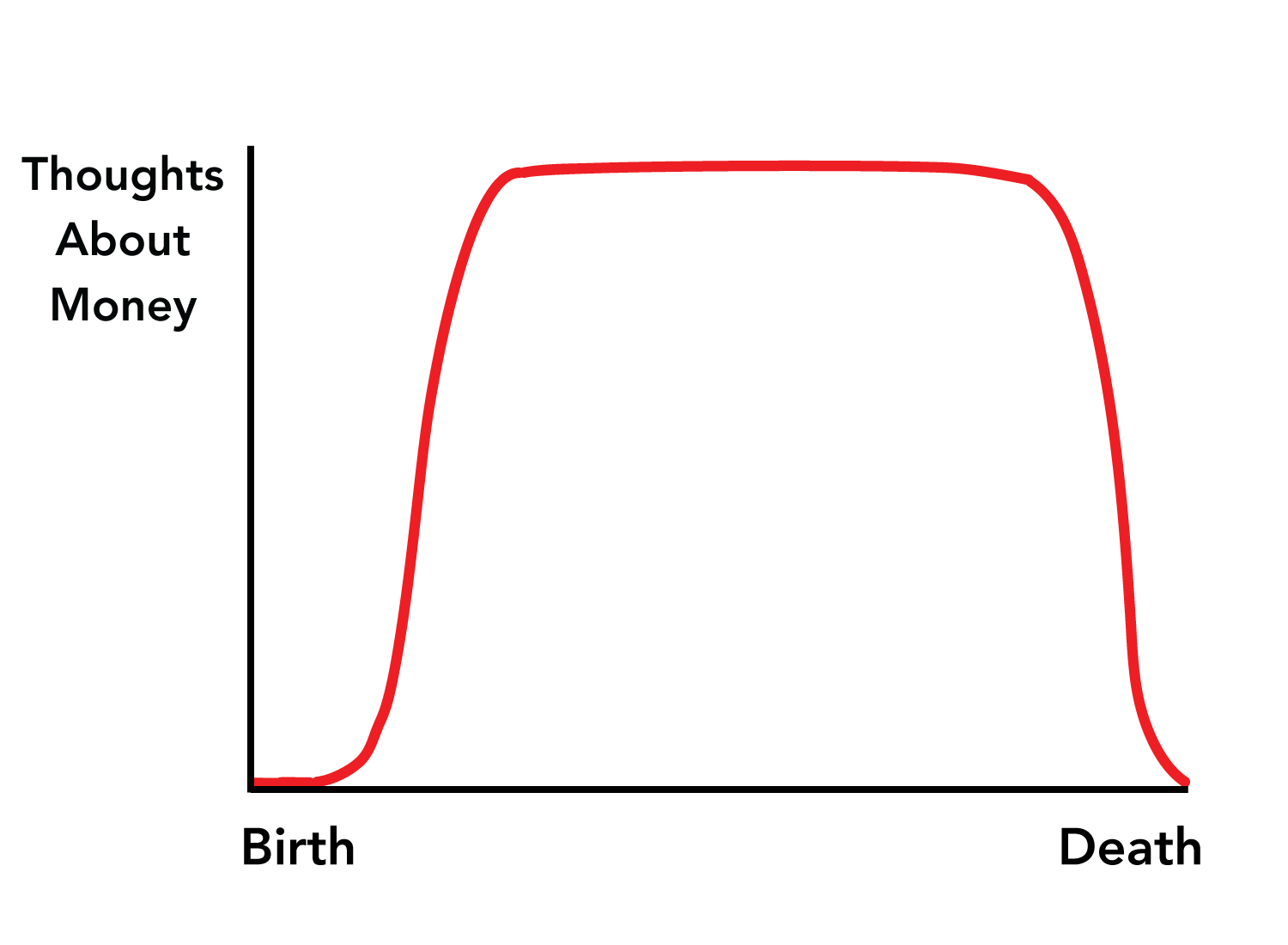

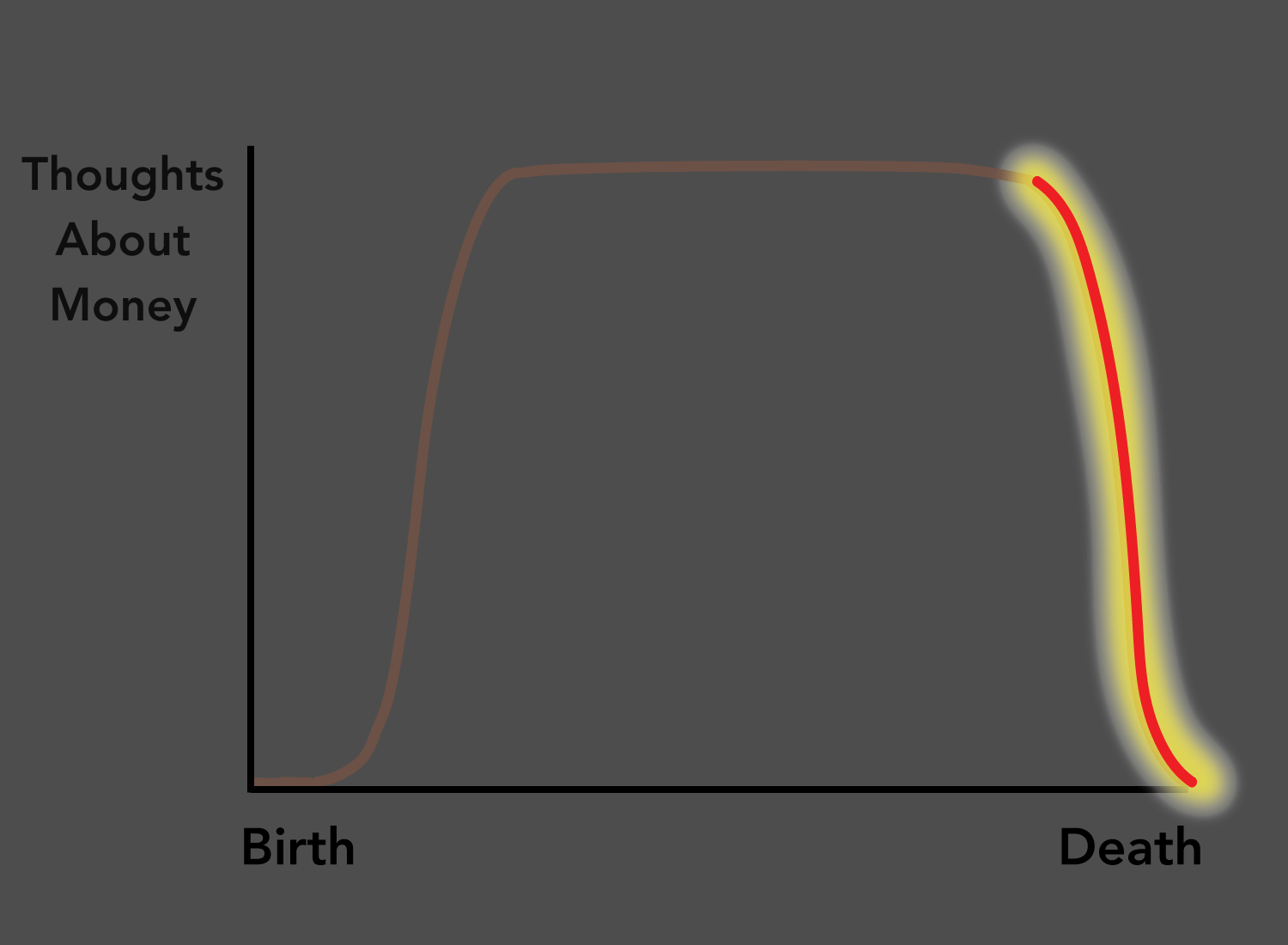

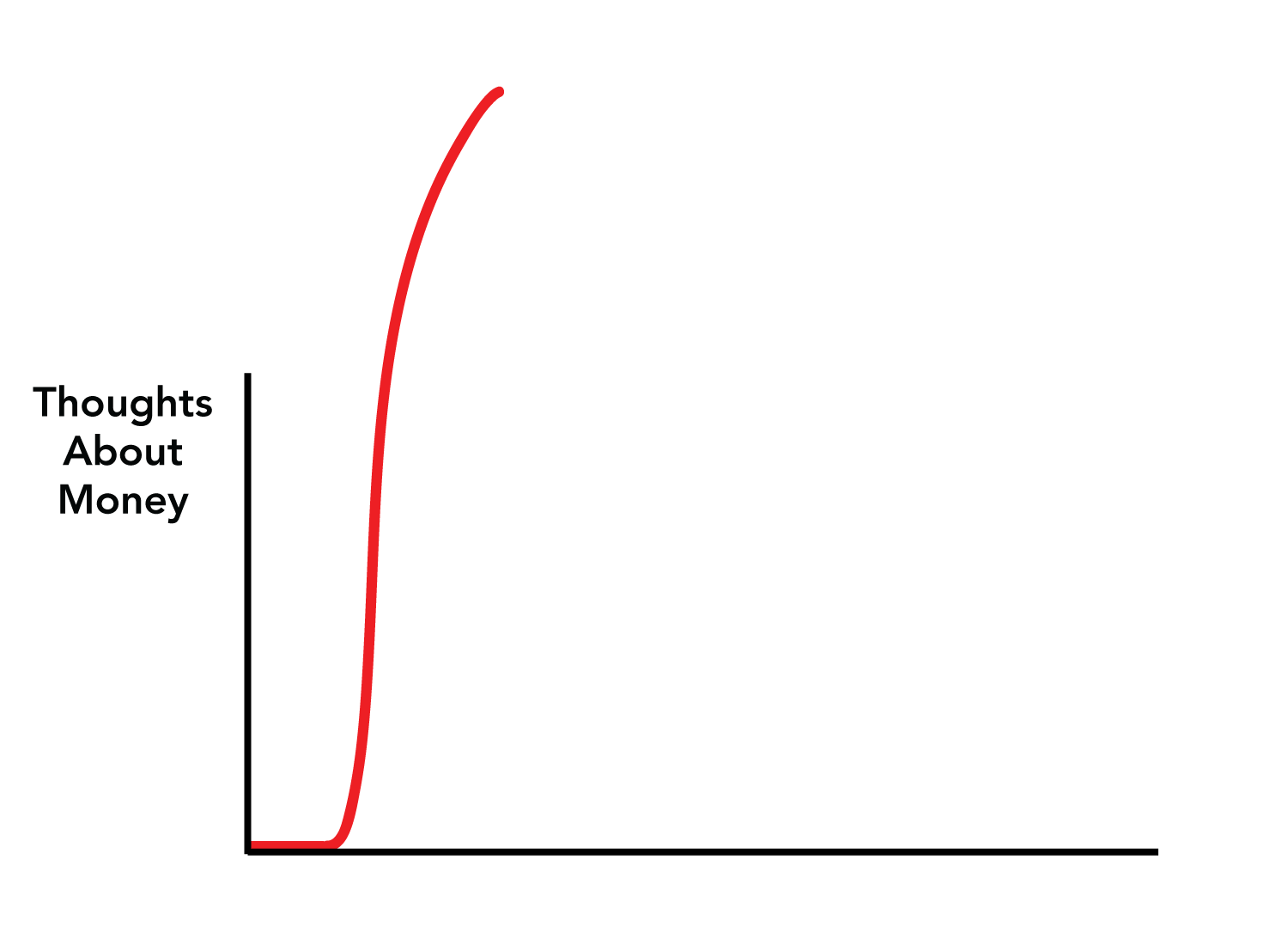

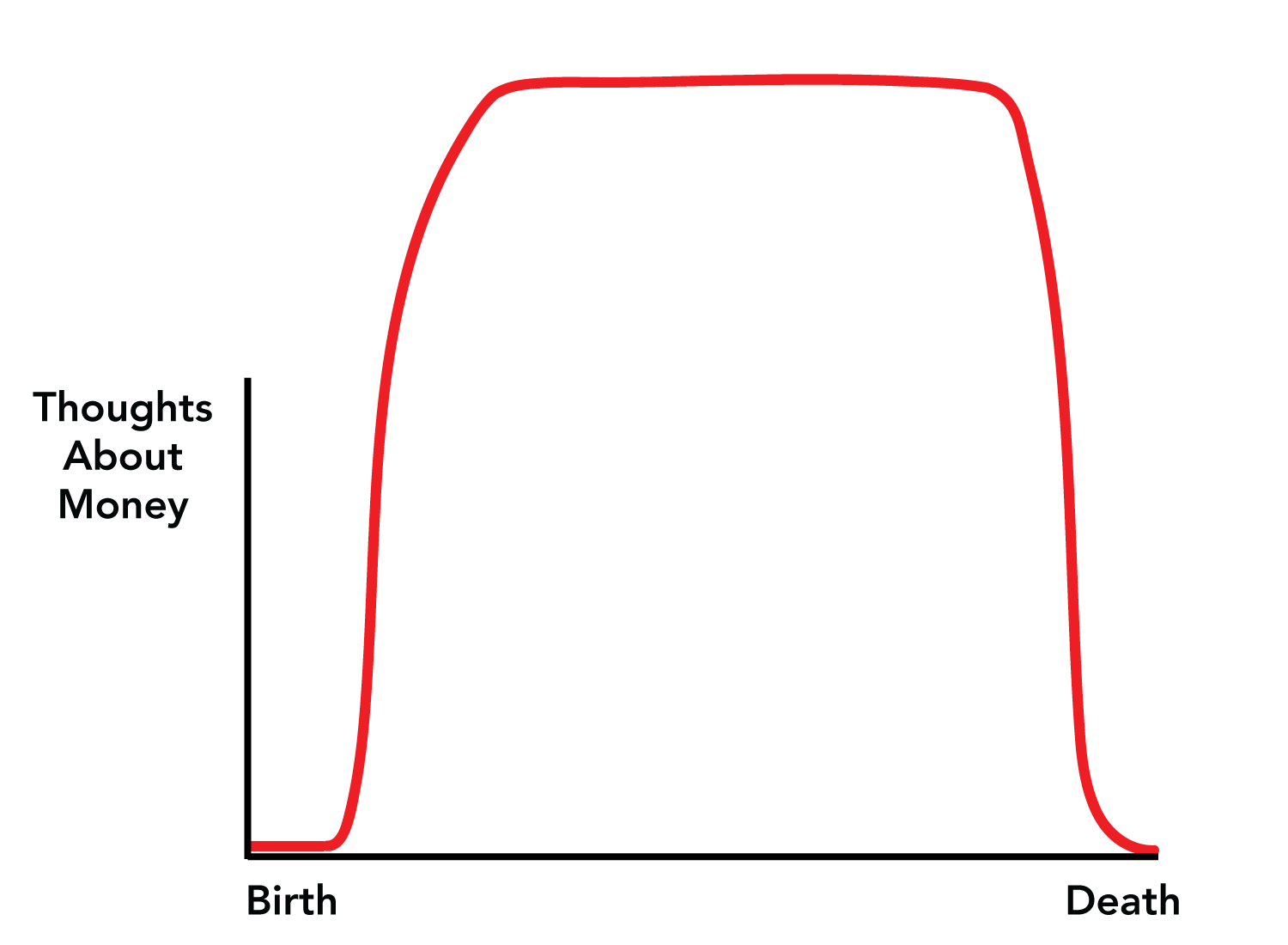

If I were to illustrate what this tension looks like for your average person, it would look something like this:

That steep descent to zero is what I call The Nothingness of Money. It’s when the pointlessness of money is no longer theoretical; it’s truly understood. This delineation is important.

Everyone knows that your bank account doesn’t go with you upon death. But for most of life, that knowledge is theoretical, meaning that it’s not real enough to influence your day-to-day behavior. The mere awareness of your mortality isn’t enough to cease your pursuit of wealth.

It is only when the finiteness of life is glaringly obvious that things change.

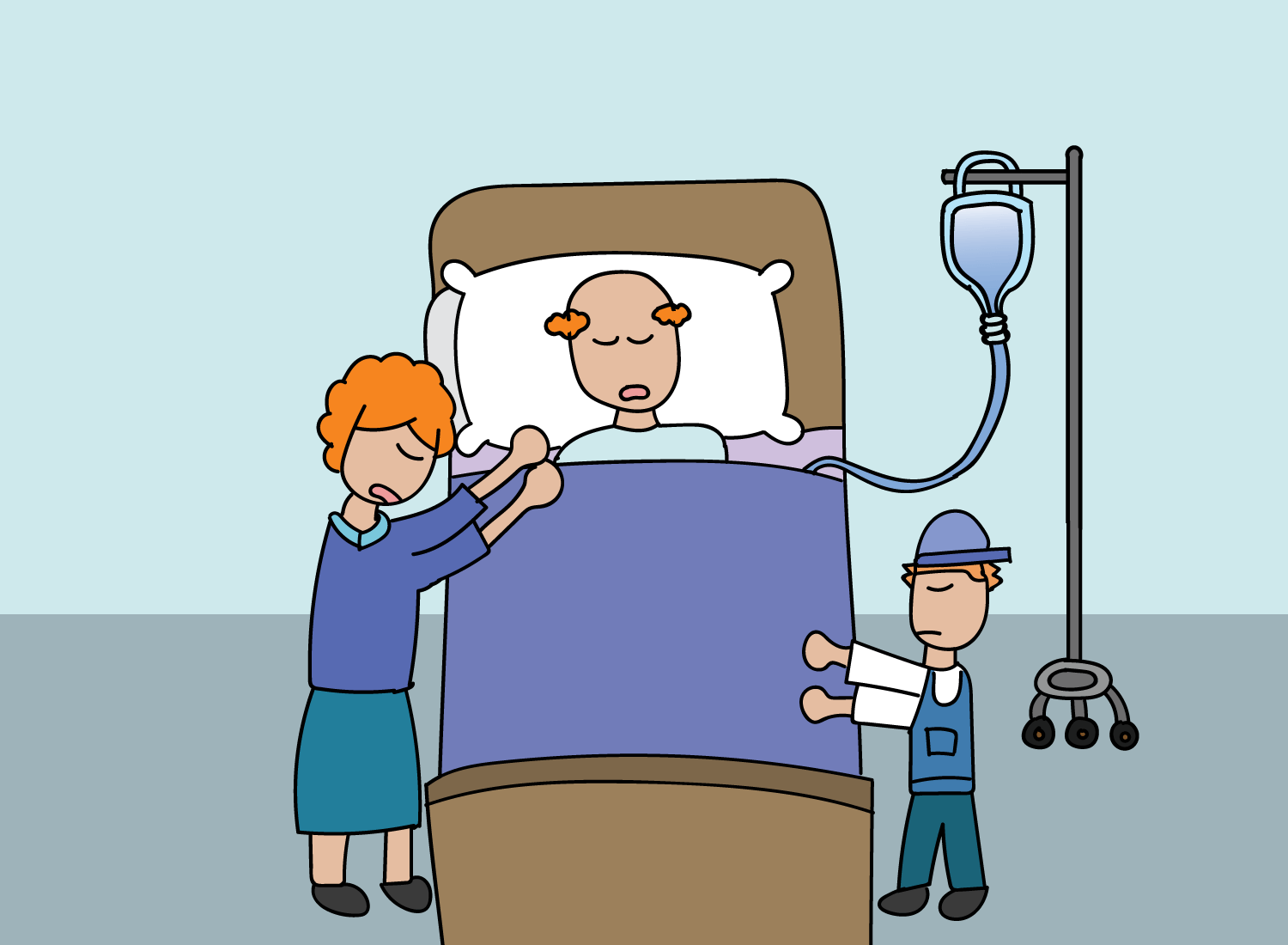

For most people, the Nothingness of Money strikes when the finish line is a few yards away. A terminal diagnosis is delivered. An appointment is made at a hospice center. A deathbed is prepared.

In this moment, a pursuit that once seemed all-consuming fades into the background. All that matters are the memories you have, the people you love, and the memories you can still make with them. The use of your finite time to squeeze out an extra dollar is laughable, as no one with a sound mind would expect that of you.

And finally, in this brief section of life, something profound happens.

The Nothingness of Money is truly understood.

While this is undoubtedly a powerful moment, I find this reality to be deeply saddening.

It’s sad that for most people, this descent is precipitous, and it happens only in the last few moments of one’s life. That it’s only through facing death in your final few yards where the spell of money is broken, and its power over your decision-making processes is discarded.

But the truth is, even this is something to be grateful for.

The Nothingness of Money is only possible through deep reflection, and this is largely enabled by viscerally facing your mortality. People with deathbed wisdom only have it because they were gifted time between a diagnosis and an end to process it all.

Others aren’t as fortunate.

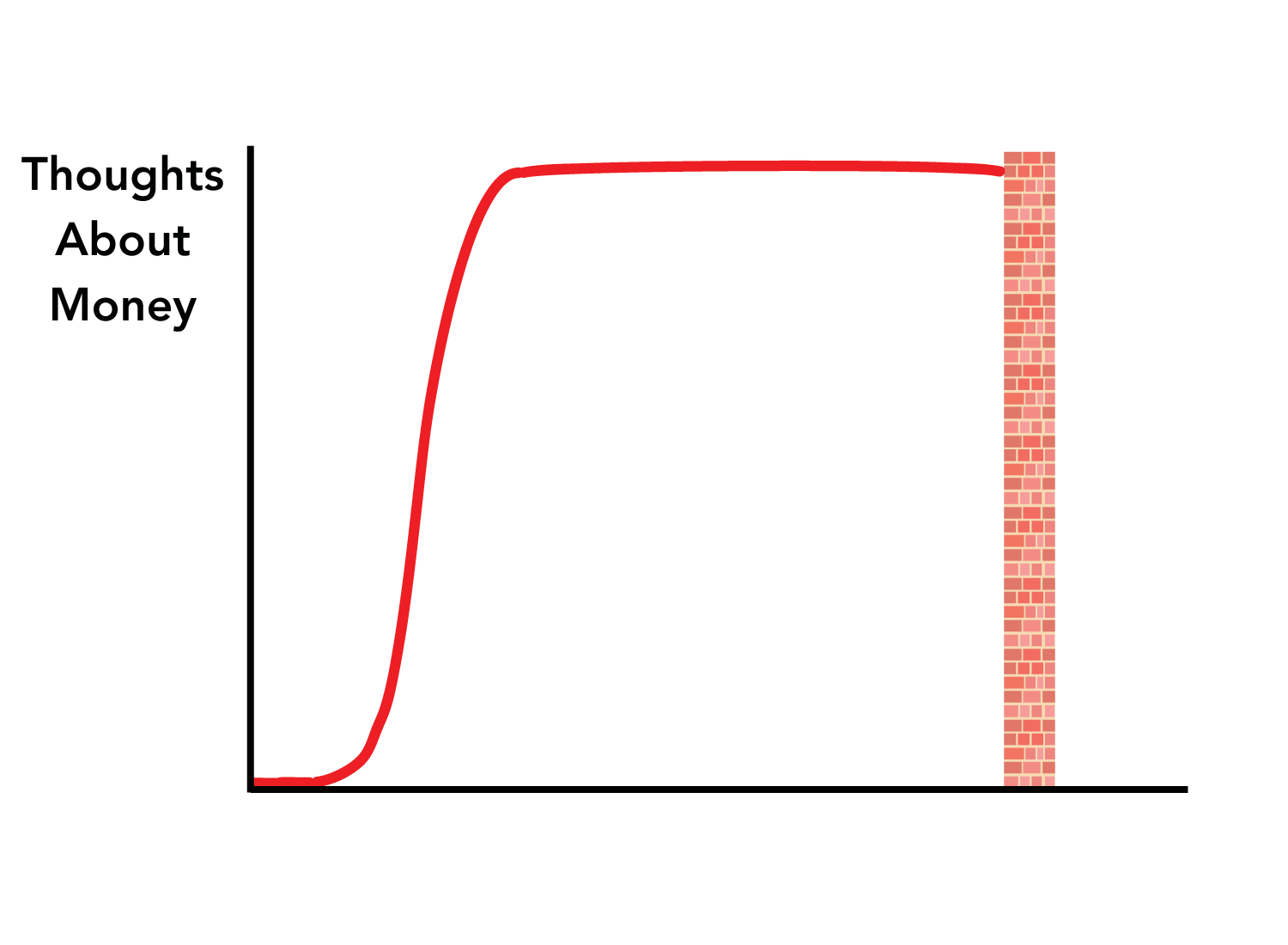

For people that depart due to fatal accidents, it’s entirely possible that they lived their lives without ever internalizing the pointlessness of money. That it was always an omnipresent force in their lives, dictating their behaviors and guiding their motives every step of the way.

For these individuals, there was no time to reflect on what matters in a way they’d never done before. And in that case, the Nothingness of Money was never truly revealed to them.

While this sounds bleak, the reality is that this is the nature of the human condition. We are aware of our mortality, but are unaware of where the finish line will be. We make assumptions using average lifespans and worldwide life expectancies, but this is primarily an exercise in quelling our uncertainties.

There is just one certainty: One day our time will be up, and we have no idea when that day will be.

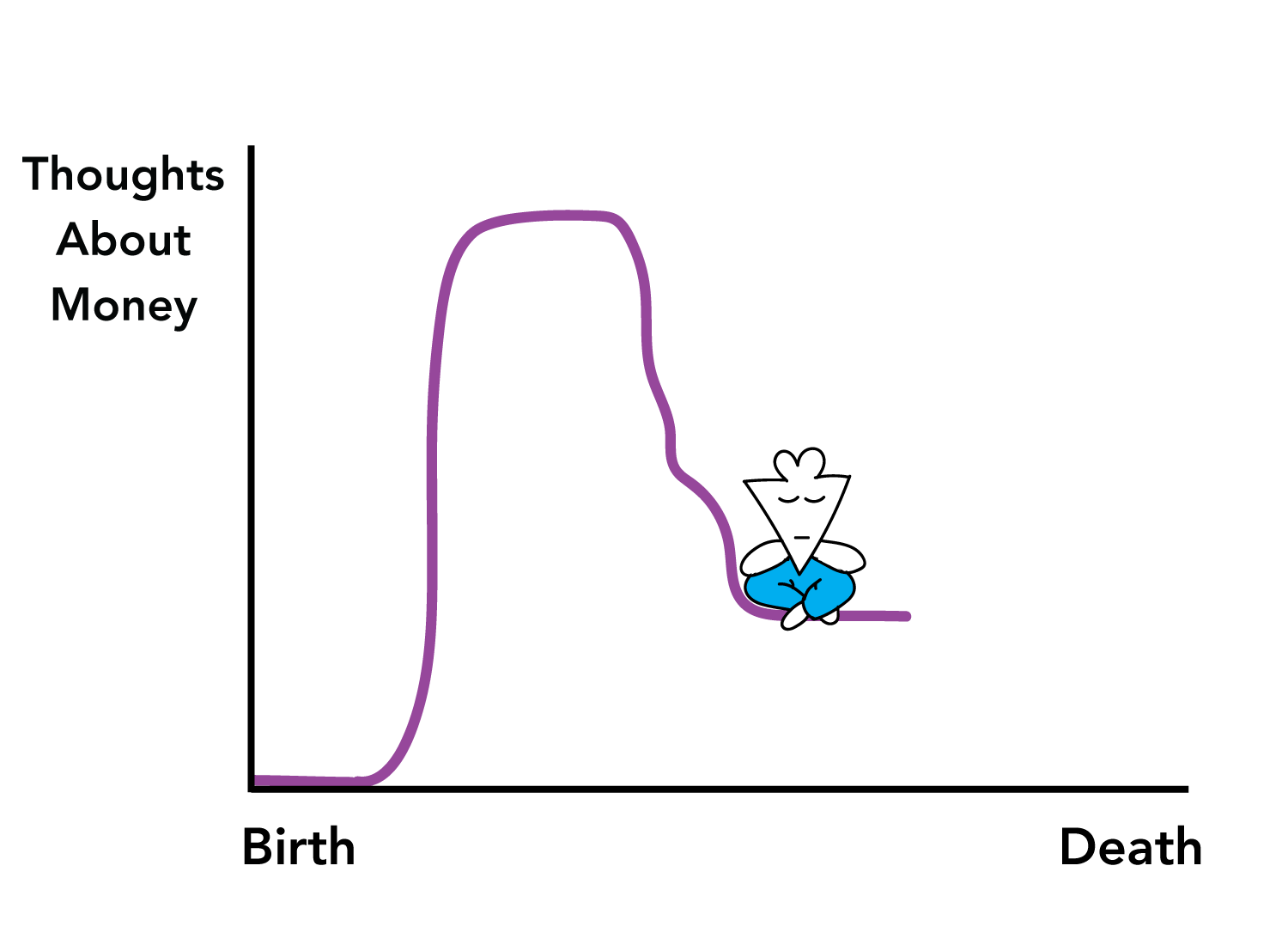

Equipped with this knowledge, people decided that they didn’t want to spend their entire lives thinking about money. They wanted the Nothingness of Money to start earlier than the last few moments of their lives, so they could spend at least a few decades living without the attentional drain of their finances.

They devised a tool that helped elongate the Nothingness of Money, and its invention ushered in a new way of thinking about financial freedom.

That tool was called retirement.

The core idea of retirement is this: You frontload your attention spent on money to generate wealth. You then offload your wealth to spend your attention on leisure, purpose, or love.

Retirement is our clever way of extending the Nothingness of Money out while we are healthy enough to appreciate it. We work hard in our youth so that we don’t have to when we’re older. We no longer have to be on a deathbed to fade money out of our thoughts, as we can do that with decades left to spare.

Traditionally, the age at which the Nothingness of Money would begin its descent is around 65. That leaves most retired people with about 2-3 decades to live a life where money doesn’t dictate how they spend their time. They can travel around the world, spend their mornings with the grandkids, or tend to their gardens. Regardless of what they do, they’re not spending 40+ hours a week somewhere for the purpose of generating wealth.

While this sounds nice, it’s no longer enough. Many people believe that the Nothingness of Money should be pushed back even further. After all, why have 3 decades of freedom when you could have 6?

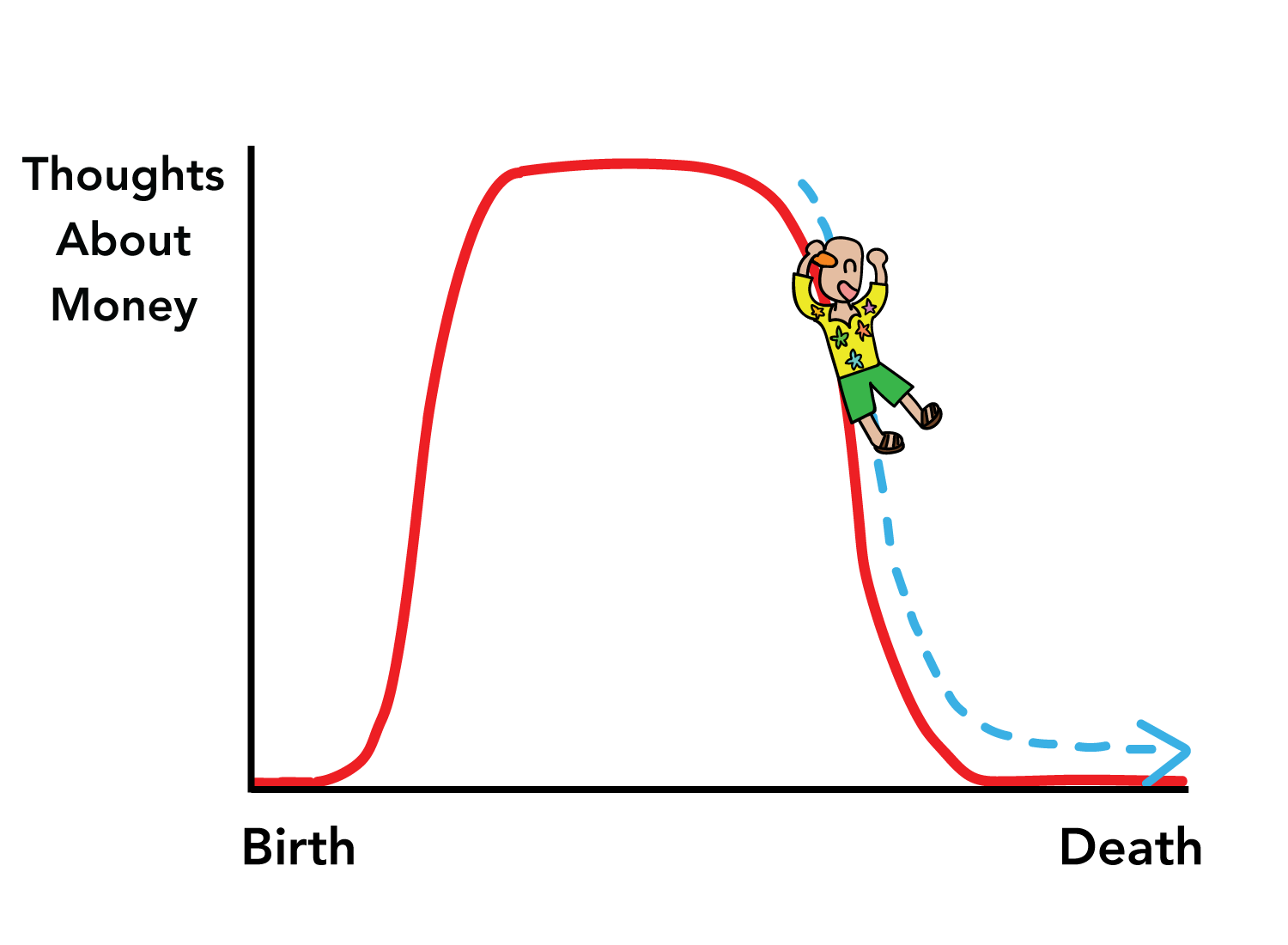

Movements like FIRE (Financial Independence, Retire Early) attempt to start the descent much earlier, resulting in a curve that looks like this:

Theoretically, this is the dream curve. You work on the right things early, make a lot of money, then implement a lifestyle that a face with many wrinkles would usually have. Your attention is freed from the burden of money, all while your vitality is preserved by the spirit of youth.

But of course, what’s great in theory breaks down in practice.

The thing about FIRE is that it requires an almost obsessive level of attention to money, especially in that initial frontloading period. Usually there is a goalpost that is being pursued, or some magical number that signifies the peak of the curve. This goal becomes the sun your behaviors orbit around, dictating what jobs you take, the products you buy, and the rate at which you monitor your expenses or check your portfolio (which I’m guessing is very, very often).

So in reality, that frontloading period looks more like this:

Surely, this isn’t a healthy use of attention, but perhaps you’d argue that this is simply the price of admission. By being maniacally focused on reaching that goal, you accelerate your ability to get there, which is what early retirement is all about. You view the world through the lens of money now so you can free yourself from it later.

The problem, however, is that this lens can’t be removed the moment you want it to.

Habit is the glue that gives perception its stickiness. If you spend 15+ years logging your expenses every night, checking your portfolio twenty times a day, and making decisions based on their fiscal impact, how plausible is it that you will stop thinking about money after you’ve reached your goalpost? If you’ve been treating money like the ultimate collectors’ item for decades, can you stop identifying with that collection once you’ve accumulated enough?

Even if you do retire early, the Nothingness of Money won’t begin its descent if your habits continue onward. If you’re still checking your portfolio every time you touch your phone, you are far from understanding the pointlessness of money. If you hesitate to invest in a better diet because of the fiscal cost, you are still held hostage by the almighty dollar.

So even in this case, it may only be through a stark reminder of your mortality that the Nothingness of Money is understood.

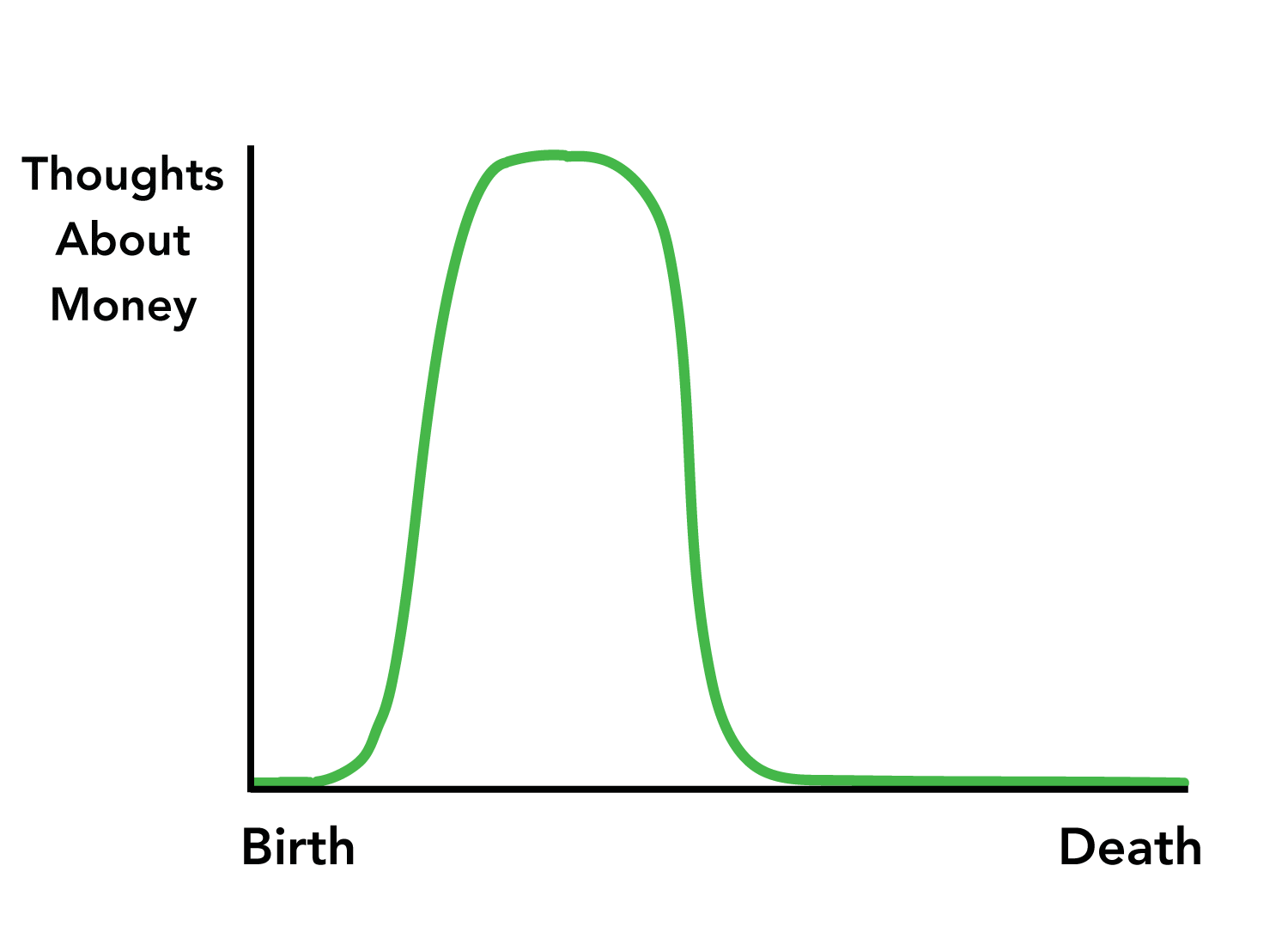

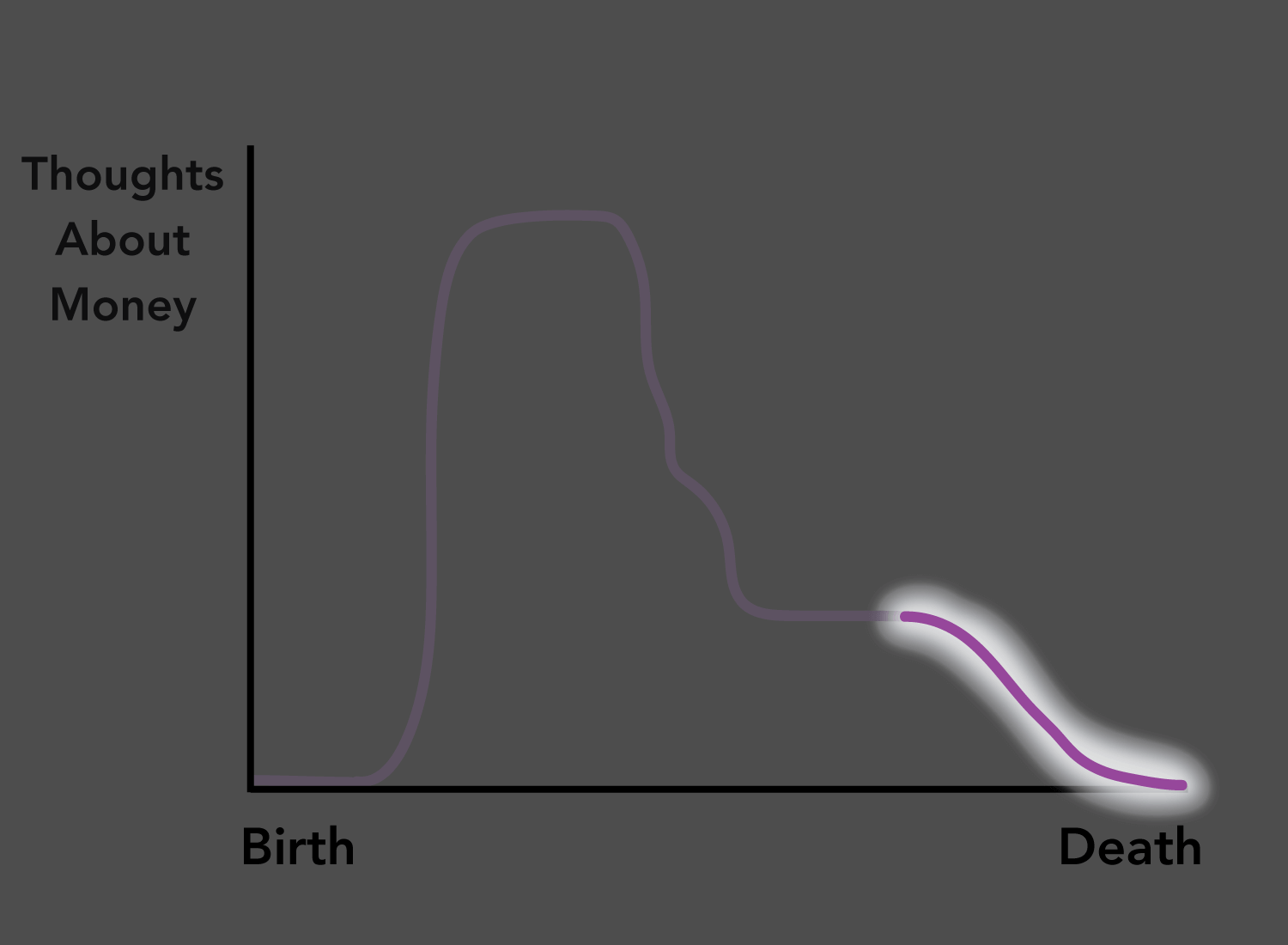

The only way to resolve this tension is to remind yourself that you are already aware of the inevitable futility of a money-centered pursuit. That what you will see as ridiculous later can actually be perceived as ridiculous now.

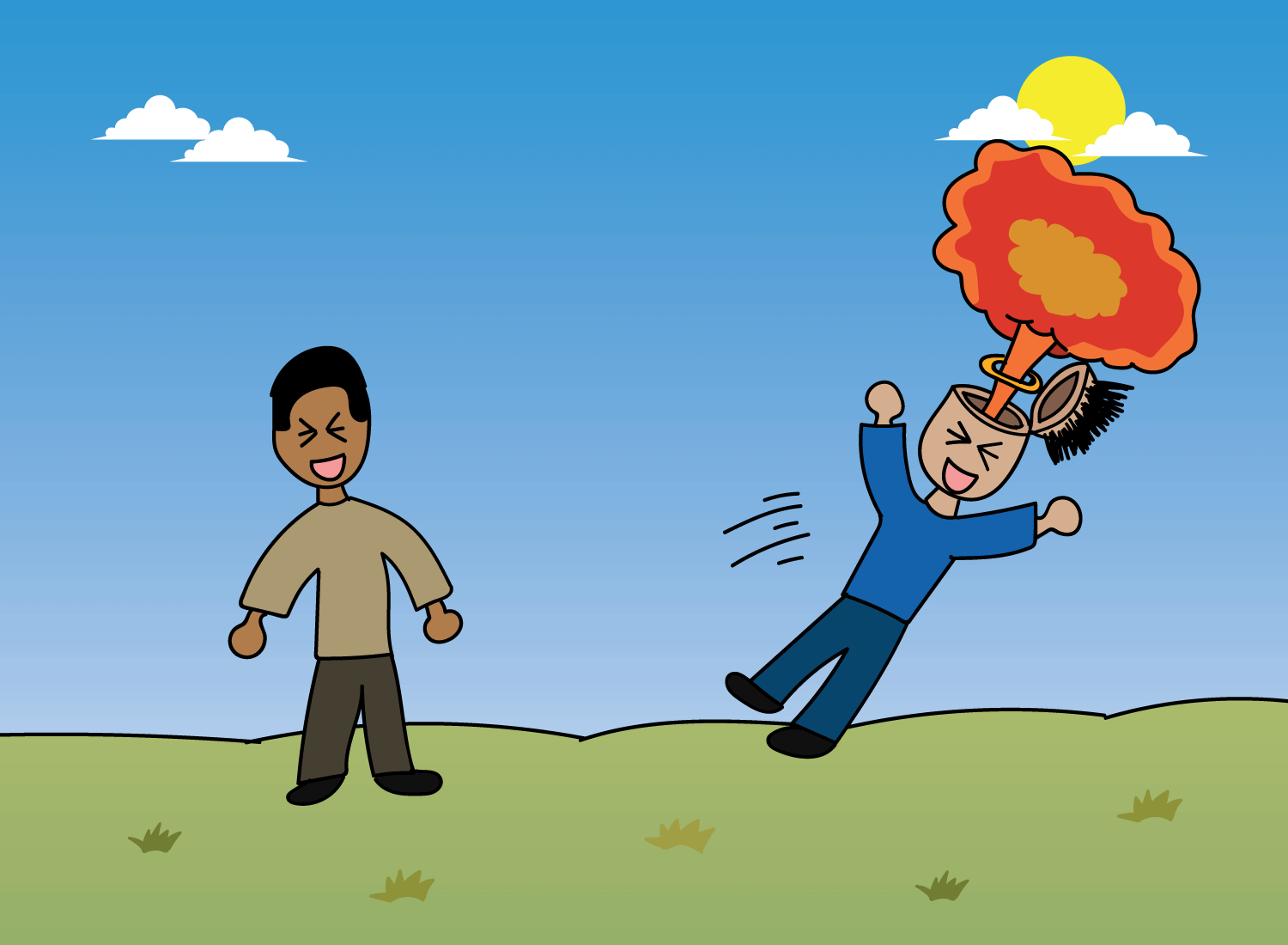

For example, if a friend told you that he wanted “I outperformed the S&P 500” on his tombstone, your immediate reaction would be to laugh. There is no way you’d take it as anything other than a joke.

The key is to take that exact feeling and remind yourself of it whenever money hijacks your attention. That when you’re fixated on its pursuit, you can break the spell by understanding how laughable it is to be remembered for it. That in the end, it will have very little to say about the person you are.

By doing this regularly, you can punctuate the spikes of attention with moments of clarity, which helps to bring the heightened plateau down to a more reasonable level.

And the lower that plateau is, the less dramatic the fall, thus minimizing the regrets you may have about the way you spent your life.

Wisdom is the co-existence of contradictory truths, and money is the clearest example of this. We must internalize its importance while also recognizing its pointlessness. We must operate within the story of money while also understanding that it’s a fairy tale.

The problem is that we often fail to see the illusory nature of this story, and treat it as gospel until it’s too late. But by punctuating our days with an awareness of the Nothingness of Money, we can make choices that don’t place finances at the helm.

We can take a leap to do something beautiful.

We can choose fulfilling work over mind-numbing jobs.

We can set aside our portfolios and be present with our loved ones.

Ultimately, we can live our lives according to what will be written on our tombstones. And given that a dollar sign won’t be on it, it’s time we stop inscribing one onto our minds as well.

_______________

_______________

Related Posts

A reminder for you to give money its purpose, not the other way around:

Money Is the Megaphone of Identity

Your relationships are at the center of a grateful existence:

How to Be Thankful for Your Life with One Simple Reset

What we can learn from contemplating our finiteness: