How Money Forever Changed Us

During my six years of elementary school, many fads came and went.

We had the Tamagotchi, a virtual pet that no one could ever keep alive:

The Furby, which still gives people nightmares today:

And of course, the Oregon Trail, a game that will forever define a generation:

But there was one fad I remember that not only took our school by storm, but schools all across the country as well. It grew so feverish that after a few months, schools had to actually ban this activity because too many students were getting obsessed with it.

If you were an ‘80s or ‘90s kid, chances are you’ll remember it too.

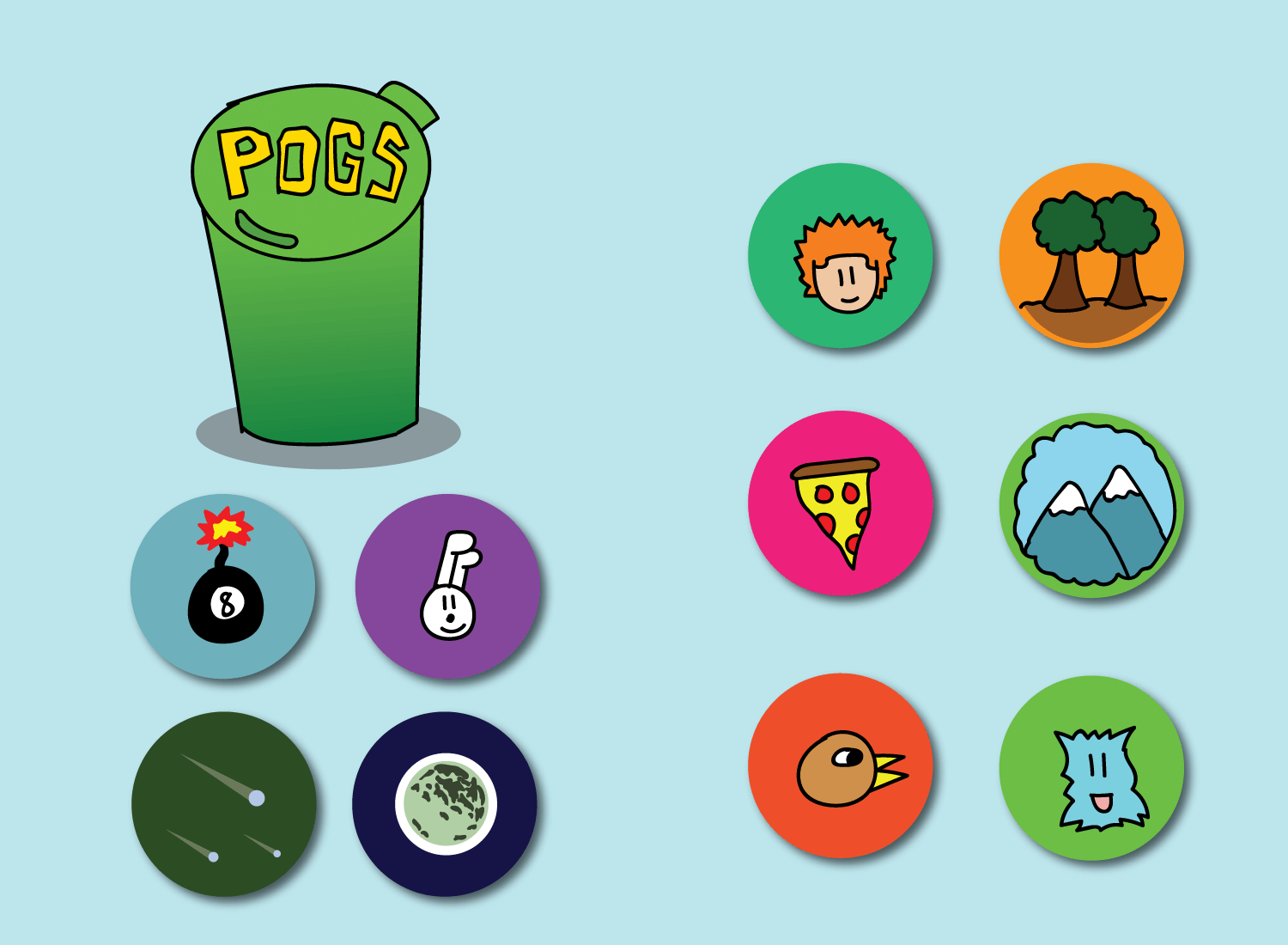

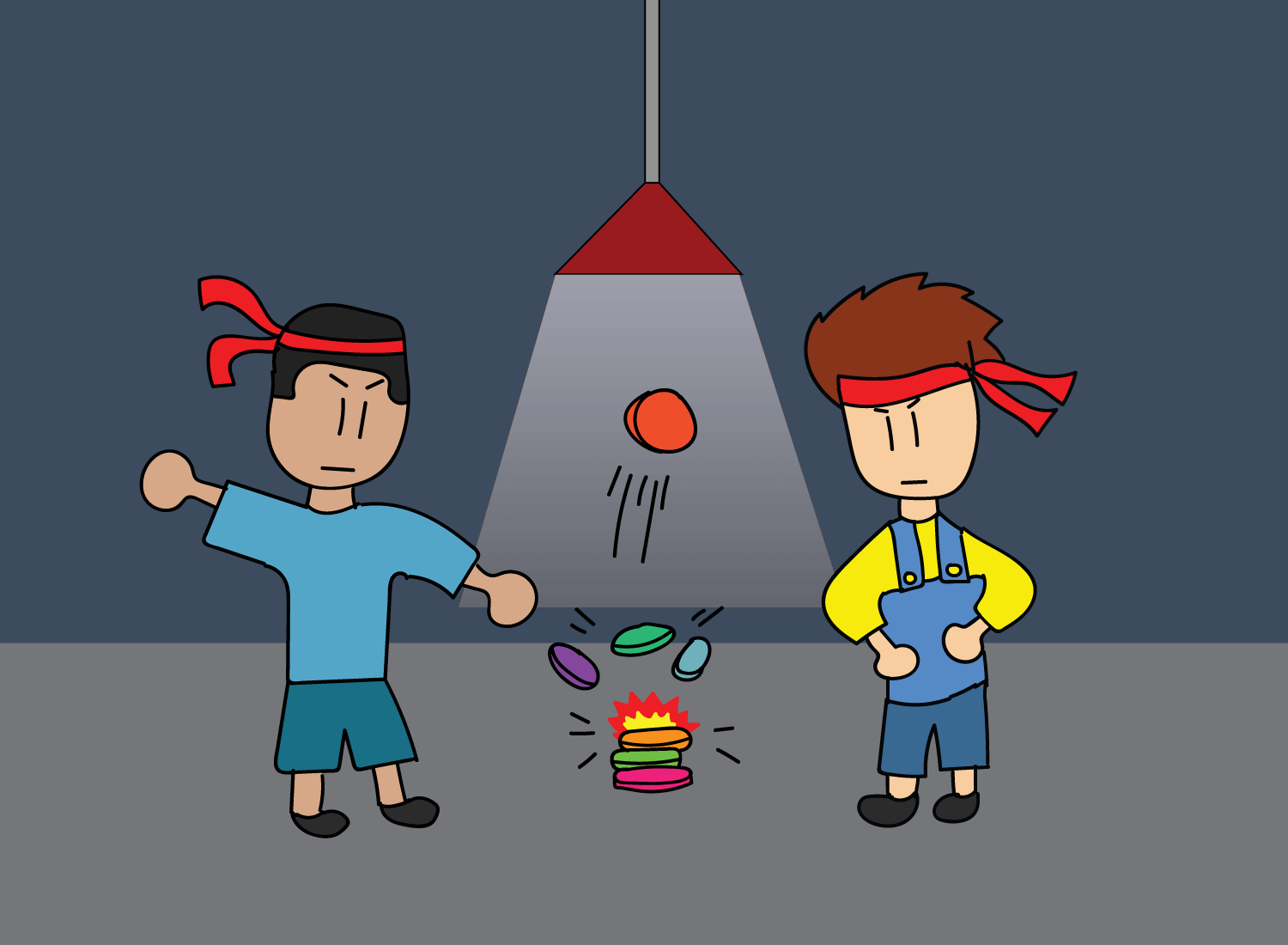

I’m referring to the infamous world of pogs:

For those that didn’t get to experience this craze, I’ll briefly break it down for you.

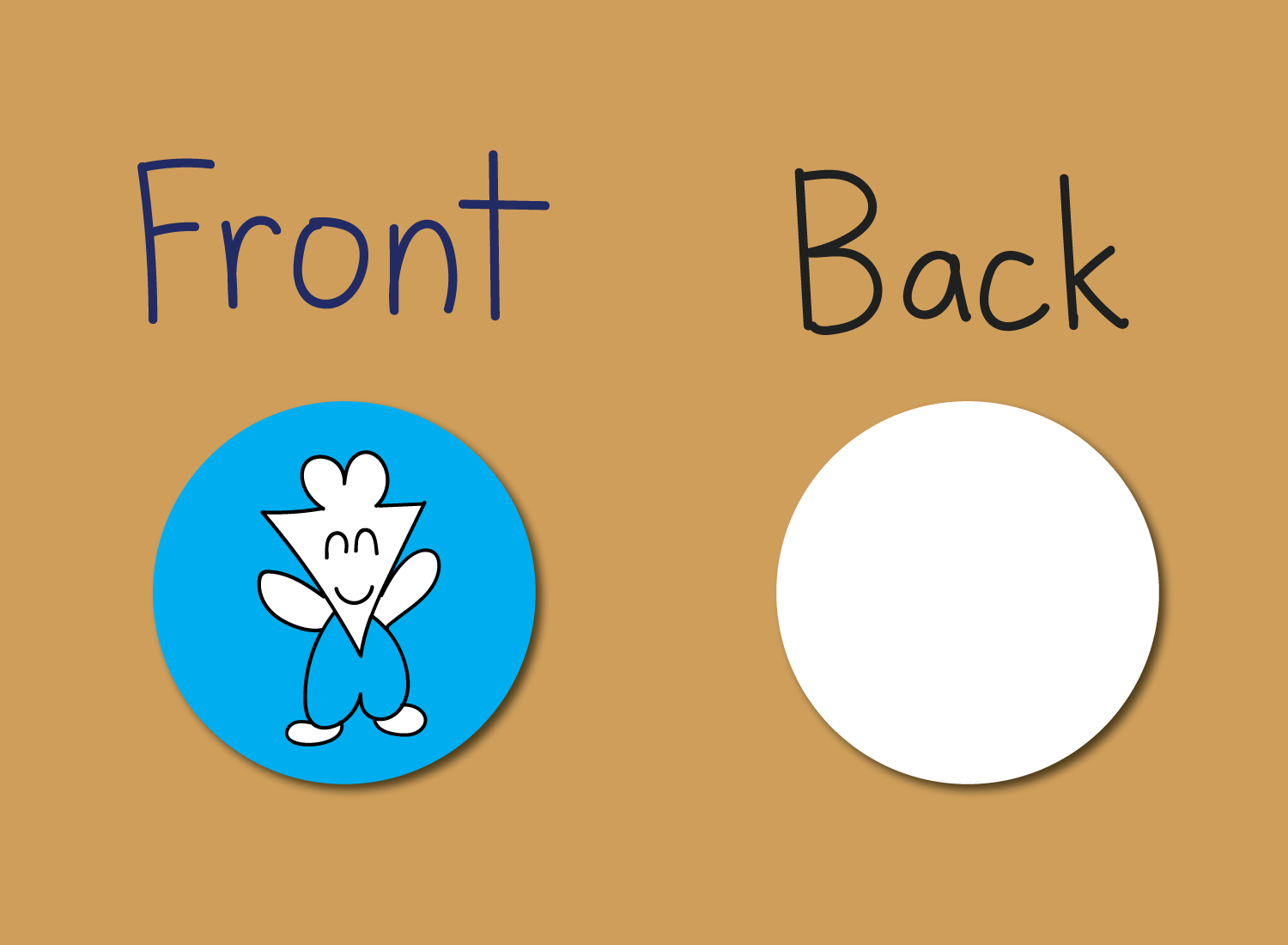

Pogs were these thin, circular discs that were largely made from one of three materials: paper, aluminum, or plastic.1 Each pog had a “face” side that had some sort of cool, colorful design on it, and a “back” side that was left blank.

The game itself was super simple, which made it ideal for 2nd graders across the world.

Each round, the players would contribute a few paper pogs, put them face down, and stack them up into one long cylinder. This is the “ante,” or the prize that the players are looking to win.

Then using a special, denser pog that was either made from aluminum or plastic (known as a “slammer” and “pounder,” respectively), each player would try to slam it on the stack, and flip over as many paper pogs as possible. Whichever pogs are successfully turned over would be the prizes they win.

That’s the whole game in a nutshell. Essentially, it’s slapping dense discs onto a stack of lesser dense discs, hoping to turn over as much of them as possible before the recess bell rings. Seems pretty harmless, right?

Well… there was one component to the game that made it a bit problematic for child psychology.

Before any game starts, you have to declare whether you’re playing “for fun” or “for keeps.” “For fun” means that you’re not actually keeping the pogs you turn over, and are returning them back to their original owners at the end of each match. “For keeps,” of course, means that you now own the pogs you turn over successfully, meaning that someone must lose something if another person wins.

Basically, a nice little gambling ring was growing amongst us starry-eyed 2nd graders.

Pogs originally started off as a little recess activity, but began morphing into something far greater.

Kids began comparing each other to how many pogs they had, and started forming groups based on the types of pogs that were owned and won. The kids with gold-plated, shiny pounders kept winning, so they needed to up the stakes and play for higher prizes. The kids that only had paper discs would be off in the sandbox being peasants.

Pogs became the shared currency of the school. Kids were trading their fruit rollups for slammers, their Lunchables for pounders. Kids were literally getting into fist fights over them. And of course, if you didn’t play pogs at all, you might as well be an invisible node of society. All that mattered was how many of them you had, and if you had the right equipment to win even more.

Eventually, the school staff saw enough crazed, disc-slamming kids in the hallways and put an end to the whole thing. They justified the ban by saying it was a form of gambling, but they probably just wanted to see things come back to normal for a bit.

The irony, of course, was that those adults were playing a very similar game in their own lives as well.

It’s interesting how money is accepted as an inevitable force in our lives, yet when we take out the concept and wrap it in unfamiliar packaging, it seems weird and dumb.

To the school staff, the whole pogs phenomenon probably seemed silly because they couldn’t understand what could be so compelling about flipping over paper and metal discs. But they wouldn’t think twice at the thought of coming into an office everyday, flipping over documents, and depositing a bi-weekly paper check in a metal machine.

In essence, the kids were doing the same thing the adults were doing: they were accumulating value in the form of a communal good. But because it took the form of something unrecognizable, it was considered dumb rather than profound. In the eyes of the adults, pogs were shittily constructed paper discs that had no intrinsic value, and only held importance because the kids themselves thought they were.

Well, those kids could say the same thing about the way we regard our own currency as well.

The most fascinating thing about the pogs phenomenon is how closely it mirrors the story of money, and how that concept naturally manifested in children.

On one side you have paper, aluminum, and plastic discs that have no inherent value – they can’t be eaten, worn, or slept on. On their own, they’re useless.

On the other side you have paper bills, metal coins, and digits on a screen that can’t be used as ends in themselves either. They’re just as useless.

Yet in both scenarios, a united story emerged that turned an intrinsically useless thing into the distributor of status, value, and prestige.

How in the world does this happen?

How does something with no intrinsic value become the universal determinant of value? And what are the implications this has on human behavior as a whole?

Discussions of money usually come with the implicit understanding that money is valuable, so they revolve around how one could accumulate more of it, or why it introduces all kinds of strange behaviors. But in this post, we’re going to take one step back and actually look at the concept of money itself: why we need it to represent value, how it impacts our goals, and how it reconstructs our idea of individuality.

This is a dive into the philosophy of money. It’s a look into humanity’s greatest idea, its greatest paradox, and the story that forever changed human behavior.

Let’s begin.

Money and The Great Abstraction

Everything starts with the fact that money has no intrinsic value.

I’m going to explain why this is, but in order to do so, I need to first introduce my favorite game show ever:

The Price Is Right is a brilliant TV show where hyped-up contestants play a series of pricing estimation games. Essentially, whoever can guess the price of random shit better than the next person will find their way to a final showcase, where they can win a combination of a potted plant, a trip to Detroit, and a brand… new…. CAR!!!

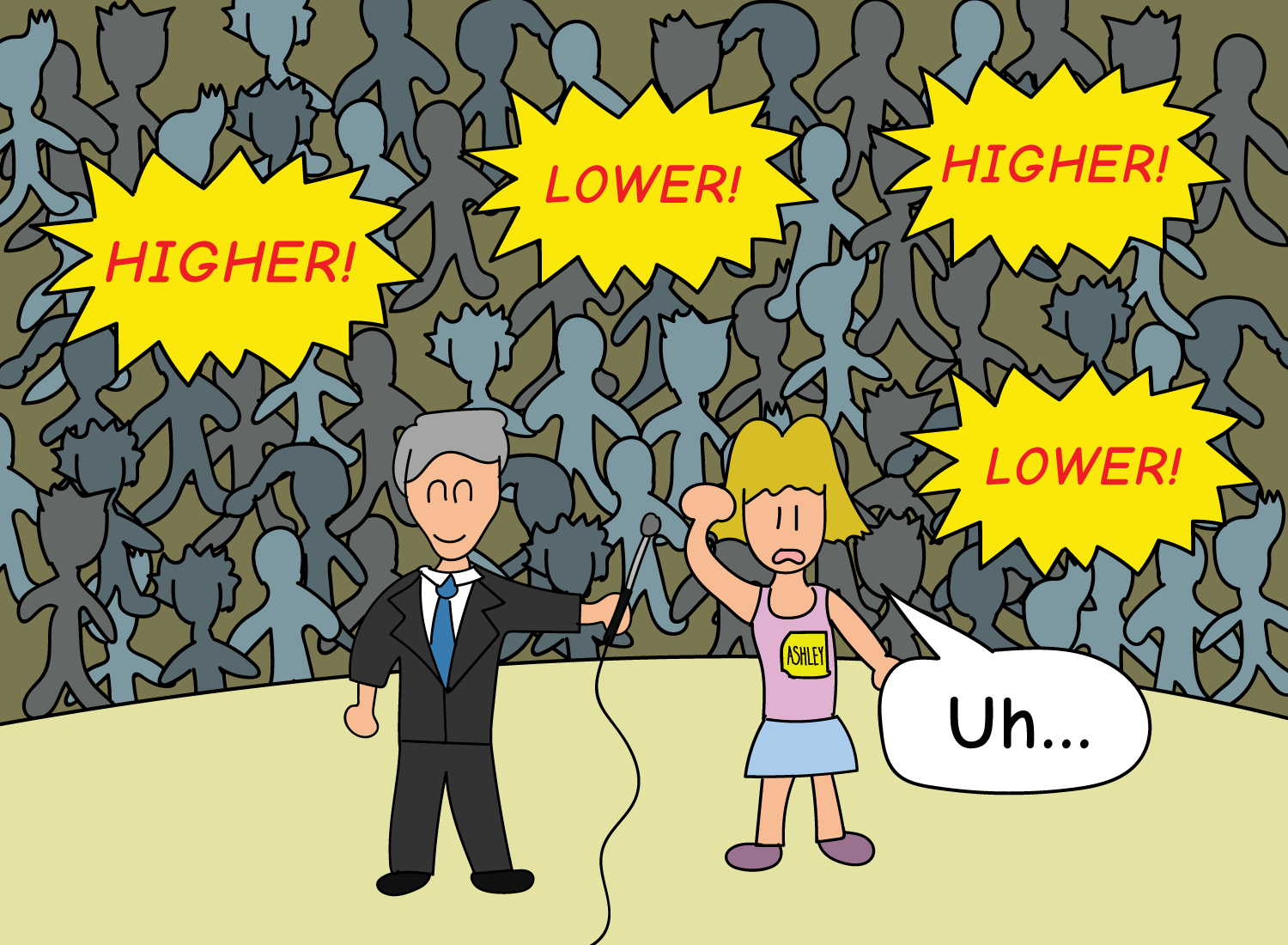

One of my favorite mini-games on the show was the Bonus Game, where the contestant must guess whether or not the real price of an item is higher or lower than what is displayed to the public.

And the best part?

The audience also gets to chime in and scream their opinions at the contestant, who then has to sort through a blend of aggressive commands to get to her final answer.

Here’s an amazing clip of the game in action:

First off, Bob Barker had jokes for days.

But second, and more important:

This game is a perfect example of the discrepancy between subjective value and objective reality.

When people in the audience are screaming their opinions of what the price of an alarm clock is, what they are doing is making a value assessment about the object in question. Each person’s idea of that clock’s value is anchored to a personal experience one has with that item, and that could be based on a host of factors.

Am I using that alarm clock now? If not, how much is the one I’m currently using? Does that featured clock look like it’d be of better quality? Wait… why do I even care about this damn clock in the first place?

From the contestant’s point of view, the audience members sound like this:

But to each audience member, every shout is guided by a judgment that is formed by personal experience, desire, and need:

Throughout all this, however, the clock simply exists. It is a collection of atoms and molecules that have been assembled to take this form, and there’s no value that is inherent in its chemical makeup. The only function it has is the one we assign it. We would primarily use it to wake up in the morning, but if there was a scary cockroach nearby that we wanted to get rid of, we could use the clock as an anvil too.

This creates a scenario where reality simply is, but the value we assign it will vary based upon the individual that interacts with it. And as illustrated in The Price Is Right, that value is spread across a spectrum of infinite wants and experiences, where one person would be willing to give up more than her neighbor, and vice versa.

For any one item of reality, there will be all kinds of value assessments attached to it, none of which are expected to be the same.

So we need to form an intermediary between reality and value that could bridge the gap between the two. A way to standardize infinite value assessments into something understandable and transferable.

That third-party, of course, is money.

Money’s greatest achievement is its ability to standardize value across otherwise incomparable realities. For example, there’s no way I could tell you how many clocks I’d give for your car, or how many clocks I’d give for your house. But communicate those objects of desire through the language of money, and I’ll be able to calculate some relationship between the two.

This ability to create value relationships between every object or service is what allowed money to build a web through every corner of life. Before money, goods stood on their own because they were simply bartered for another object of desire. But after money, the value of goods were always calculated based on a third-party: some currency that was agreed upon by all the members of that society.

The question here then becomes: how was that currency determined?

In money’s early history, it needed to have some sort of value inherent in it for people to trust it as an intermediary.

Its first iteration appeared in Sumer around 3,000 BC, where it manifested in the form of barley grains, which were measured in units called the sila (about 0.25 gallons). Despite the fact that they were quite burdensome to carry around, they were accepted as a form of money because they had intrinsic biological value: they could be eaten, which made it a legitimate currency.

The next substantive iteration came with precious metals, which first appeared in Mesopotamia via the silver shekel.2 This was a breakthrough in the history of money, as silver had no intrinsic biological value – it can’t be eaten for energy nor be worn for warmth. However, the precious metal did still have intrinsic value, only that this time, it was cultural. Whenever these metals were actually used, it was primarily for the creation of jewelry, crowns, and other accessories that acted as status symbols for the rich and prosperous.

Through the historic relationship between precious metals and status, the coins carried an intrinsic value that people easily agreed upon.

The next breakthrough in money is perhaps the most interesting from a philosophical perspective.

With the introduction of the banknote (which first appeared in China around the 11th century), money became personified through paper, a good that had neither biological nor cultural intrinsic value. You couldn’t eat paper, and wearing it probably just meant that you were homeless.

However, its legitimacy was established rather abstractly, in the form of a promise from the government that these pieces of paper would be recognized as a store of value. It was the first time that the worth of a currency was validated solely by a story that was being told, as opposed to the currency legitimizing its worth by the value that is inherent in it.

This was the beginning of a growing separation between money and any notion of intrinsic value.

Over time, economies grew increasingly complex as societies became interconnected. As trade routes expanded across the world, bills of exchange were created, each of which embodied the story that a buyer would make payments by some future date. These early forms of credit became the precursor to the modes of payment we are all familiar with today: checks and credit cards that do not carry a single iota of intrinsic value within them.

Fast forward to today, and money is nothing more than bits on a screen, instantly transferred from one node to the other at the tap of a button. It has been fully divorced from any tangible good, and the concept of value is purely ethereal: one that takes no shape or form, but hovers above as a collective story that governs all of material existence below.

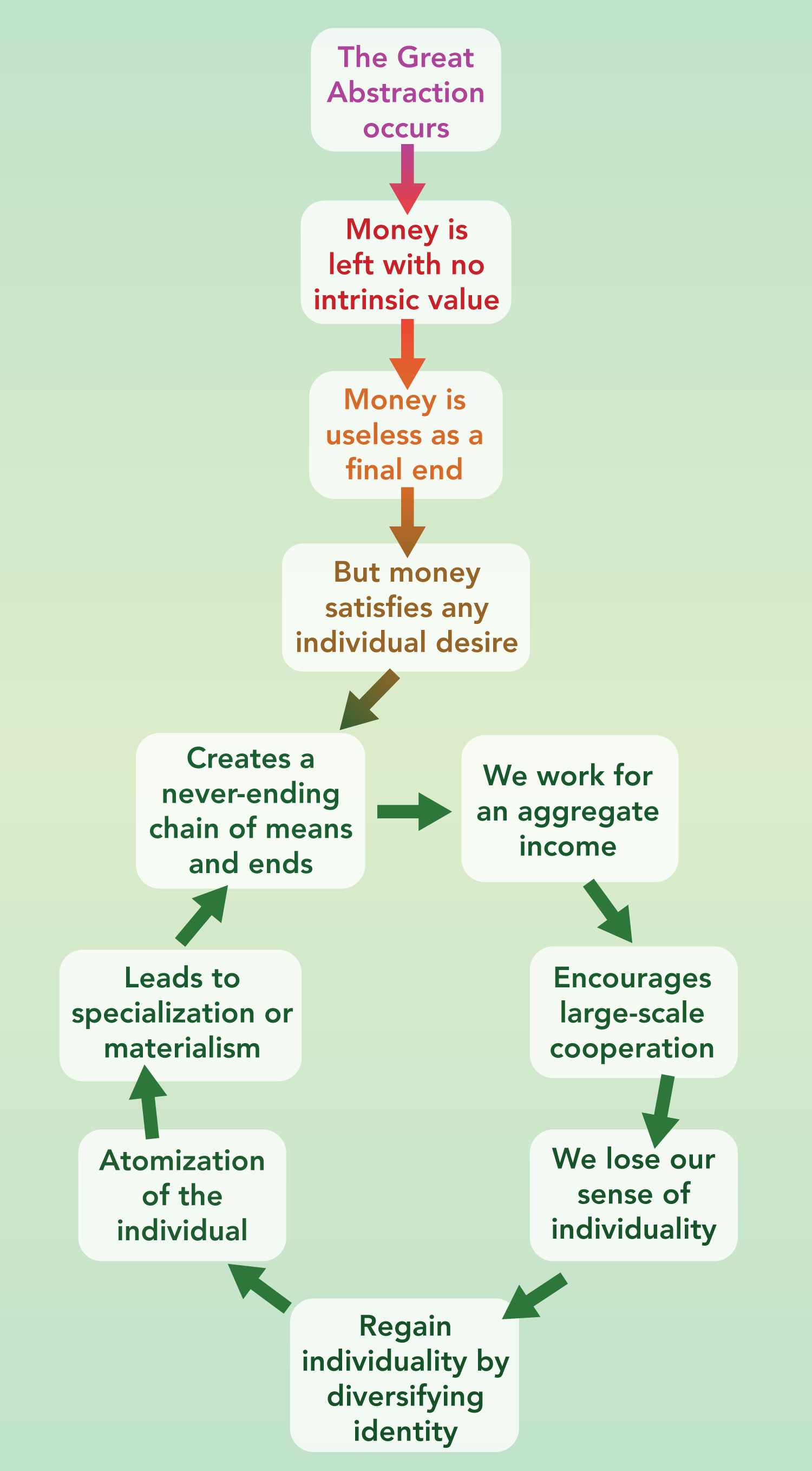

This is what I call The Great Abstraction, the movement of value from that which is tangible to that which lives purely in the mind. We can no longer visualize money in a form that we can grasp, as even the images of cash in briefcases is a dated trope from 90s action movies. Instead, it has been abstracted into this formless entity that is meaningless on its own, but means everything to us in terms of how we can live our lives.

The Great Abstraction occurred because our concrete needs evolved into endless desires in our march toward modernity. What started as a primitive need for calories became pre-packaged foods in monthly subscription boxes that are delivered after you enter a few numbers into a checkout screen. Can you imagine how many people are involved in that one logistical process alone? How can intrinsically valuable things like barley and gold satisfy payment across the board, which will then be needed to satisfy the endless desires of those very people as well?

The paradox of money is that in order to convey value, it needs to have no value of its own. In order for it to be transferred universally across any imaginable desire, it needs to be formless and empty of any meaning. It is only through its abstract nature that it can create a web of value between everything in the material world, and solidify the story we tell each other about its significance.

But what are the effects that The Great Abstraction has on the way we view our own lives, and the goals we set for ourselves? When we use the formless tool of money to guide our perceptions of value, how does this shape human behavior, and the sense of individuality?

Using an abstract concept like money to value things like purpose and goals is bound to get tricky, and we’re going to go into some of that haze now.

The Never-Ending Chain of Means and Ends

This is Moof.

Moof lives in 40,000 BC, and is quite hungry.

To satisfy his hunger, Moof sets up a trap to catch a rabbit, and goes to a nearby tree to pick some apples.

After a few hours, Moof has what he needs, and is no longer a hungry dude.

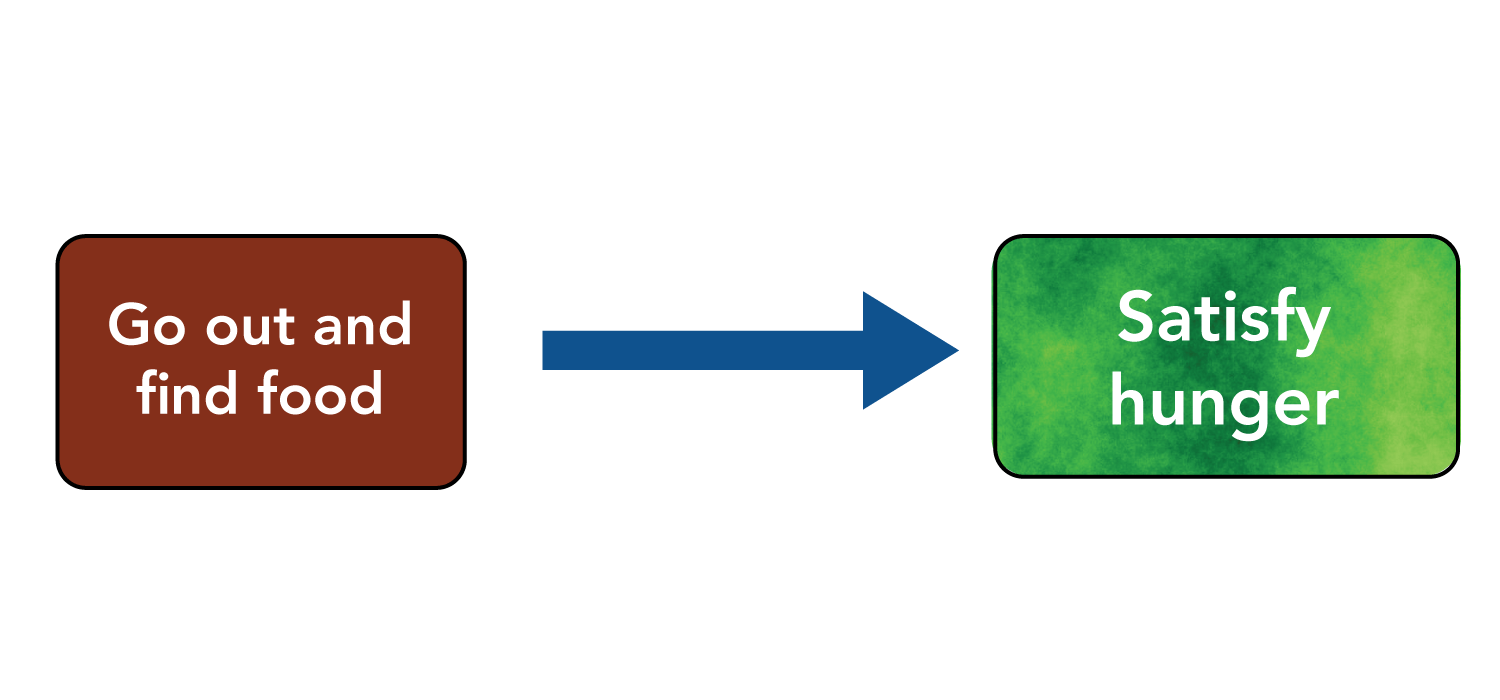

The way to reach his desired end state was simple and predictable; if he was hungry, he just went to the nearby tree to grab what he needed. In other words, his means and his ends were directly connected:

Now let’s fast forward to 2020 AD, and we have Moe, who lives in the modernized world we are all familiar with today.

Moe is feeling the same hunger that his ancestor Moof felt all those years ago, and he wants to satisfy it with some meat and apples as well.

But for Moe, he can’t go hunt for his own meat or sneak into his neighbor’s yard to pick apples without being an asshole.

He has to walk over to the nearby market to get what he needs.

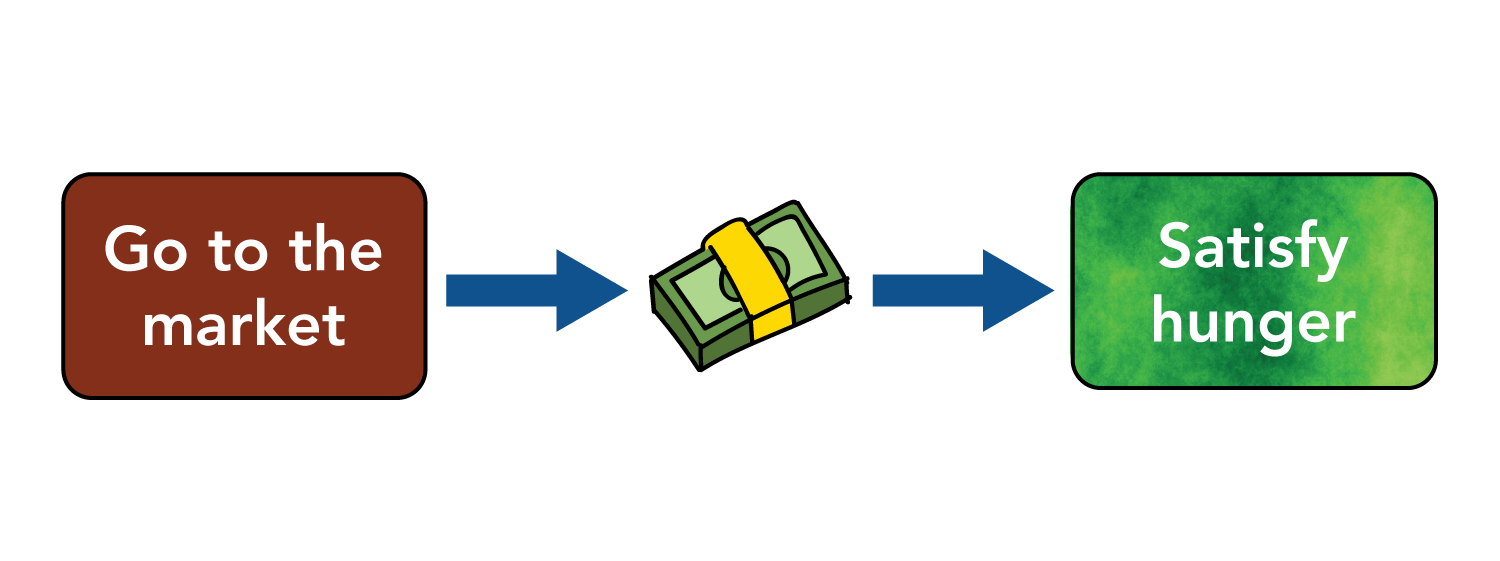

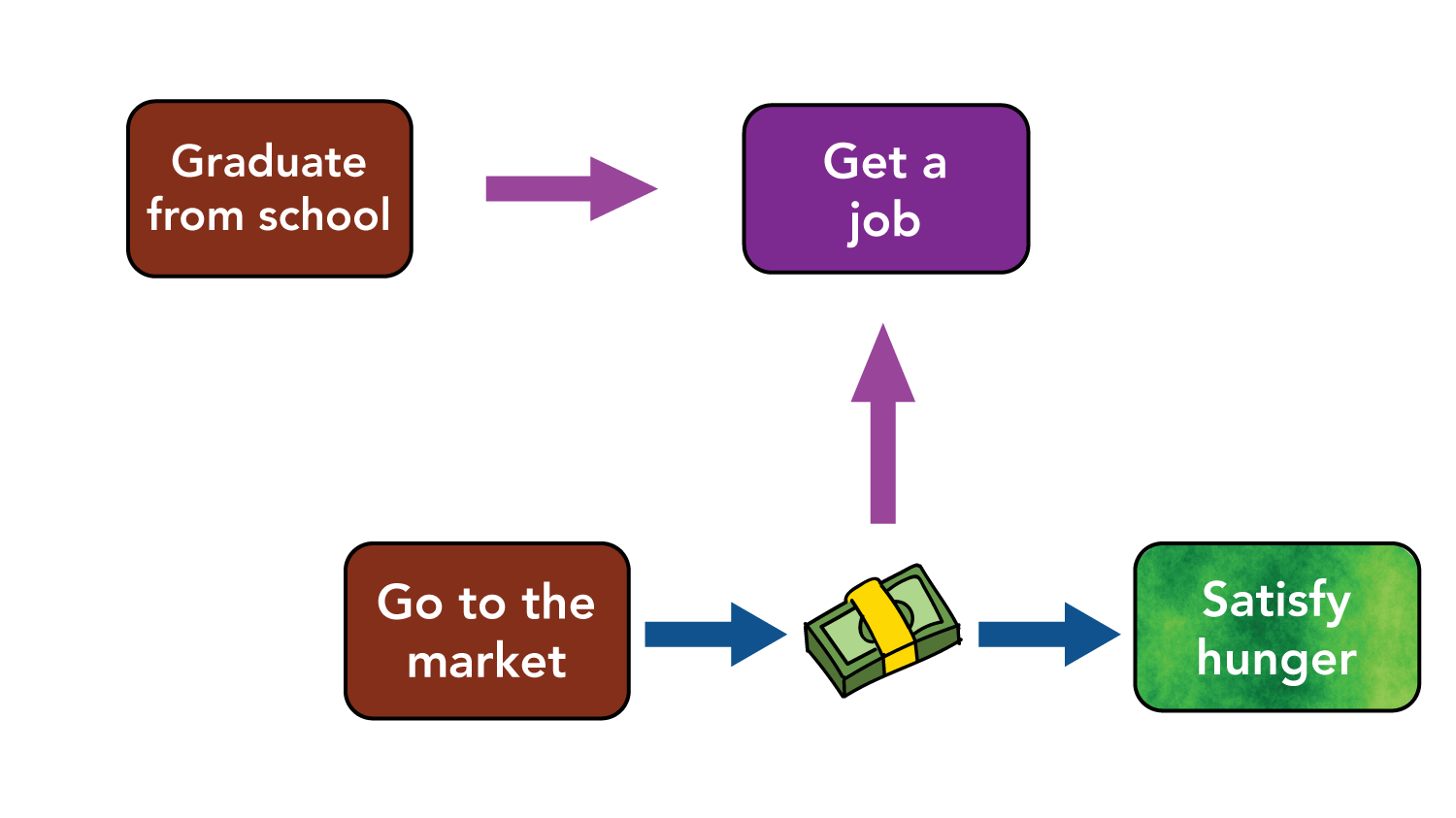

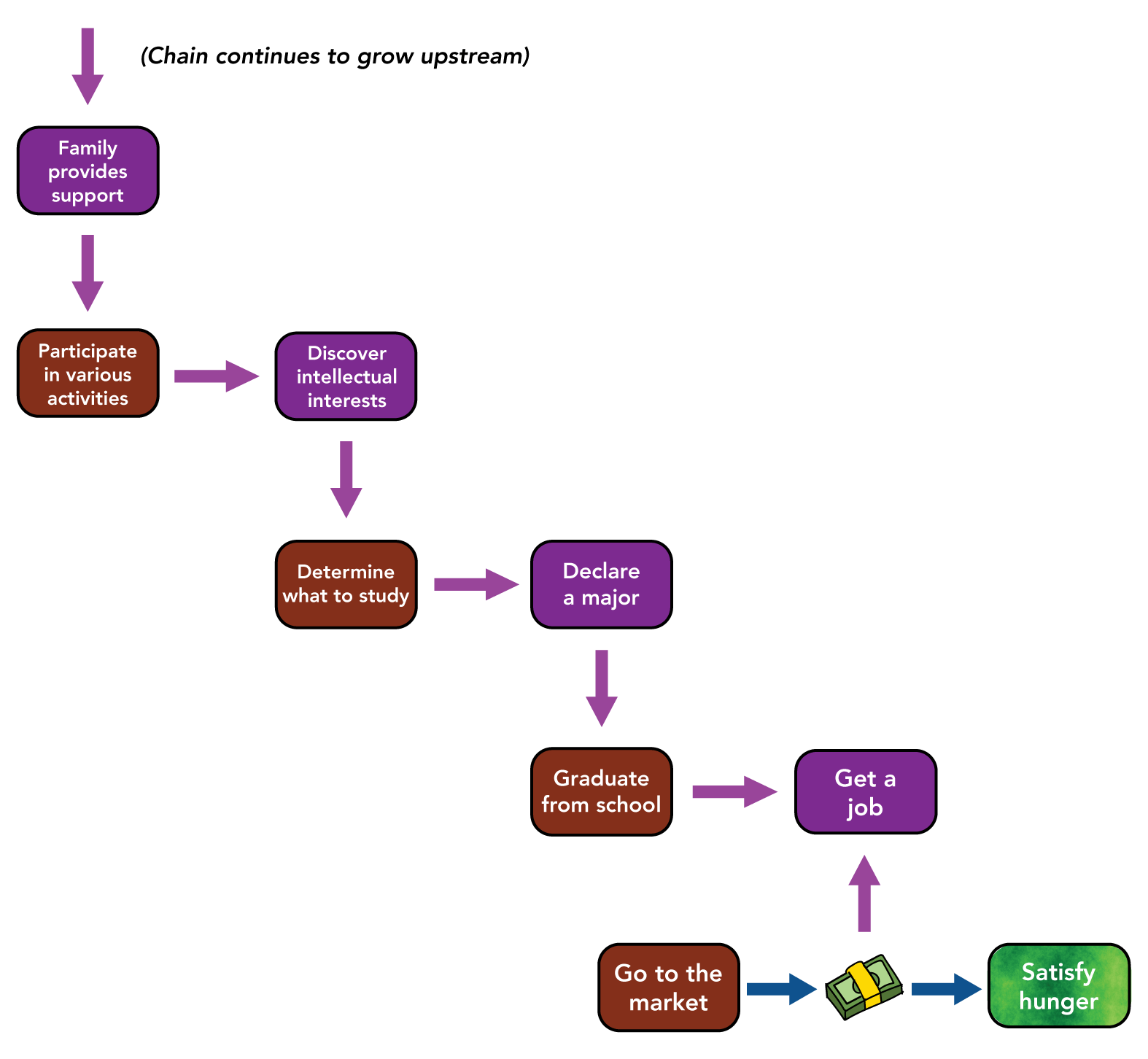

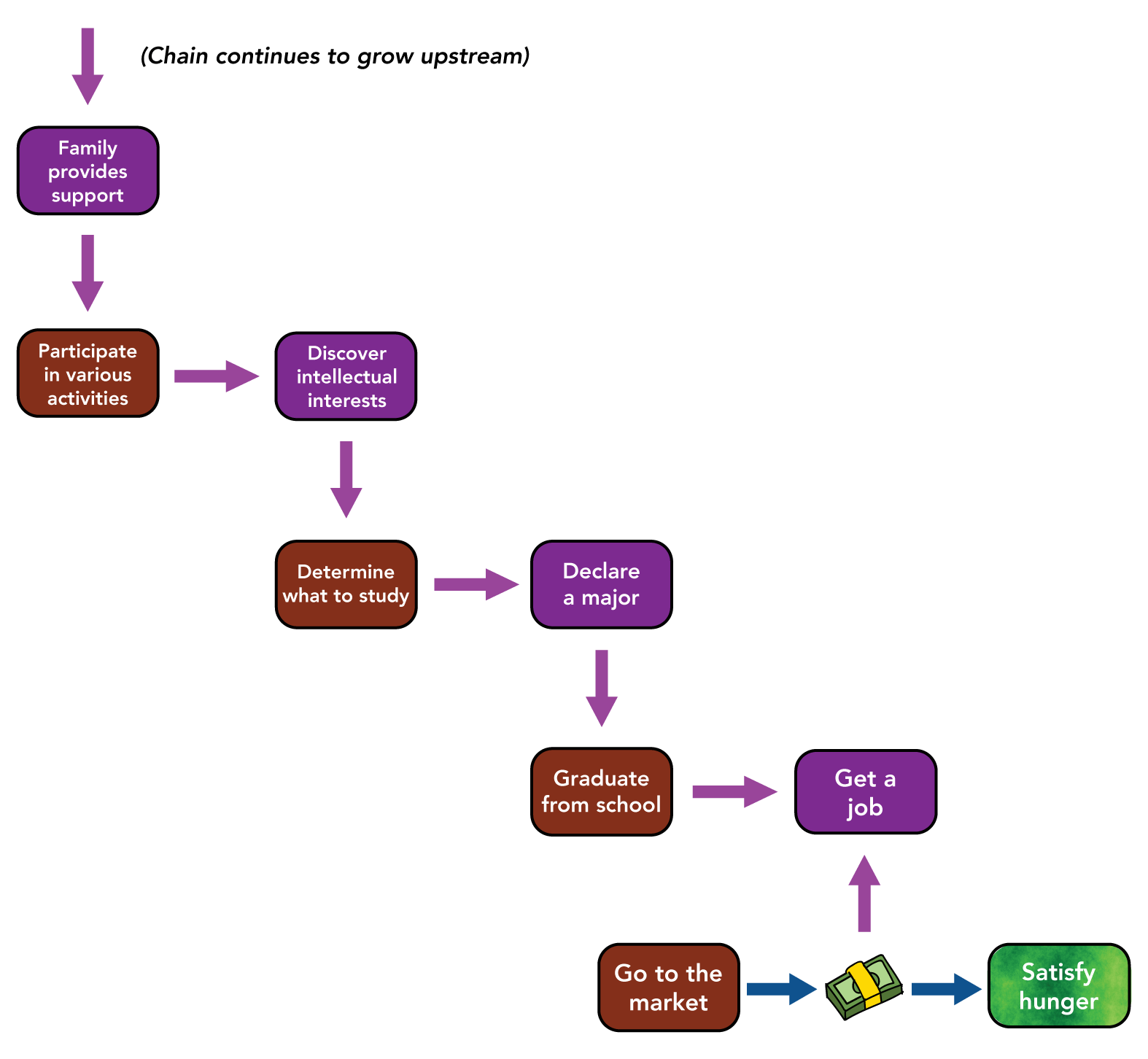

He finds the meat and apples he wants, but in order to take them home, he needs to give the market money. So in between his means (go to the market) and his end (eat food), another means must exist, which is to earn the money he needs to purchase that food.

But then that introduces the question, “How does Moe make that money?”

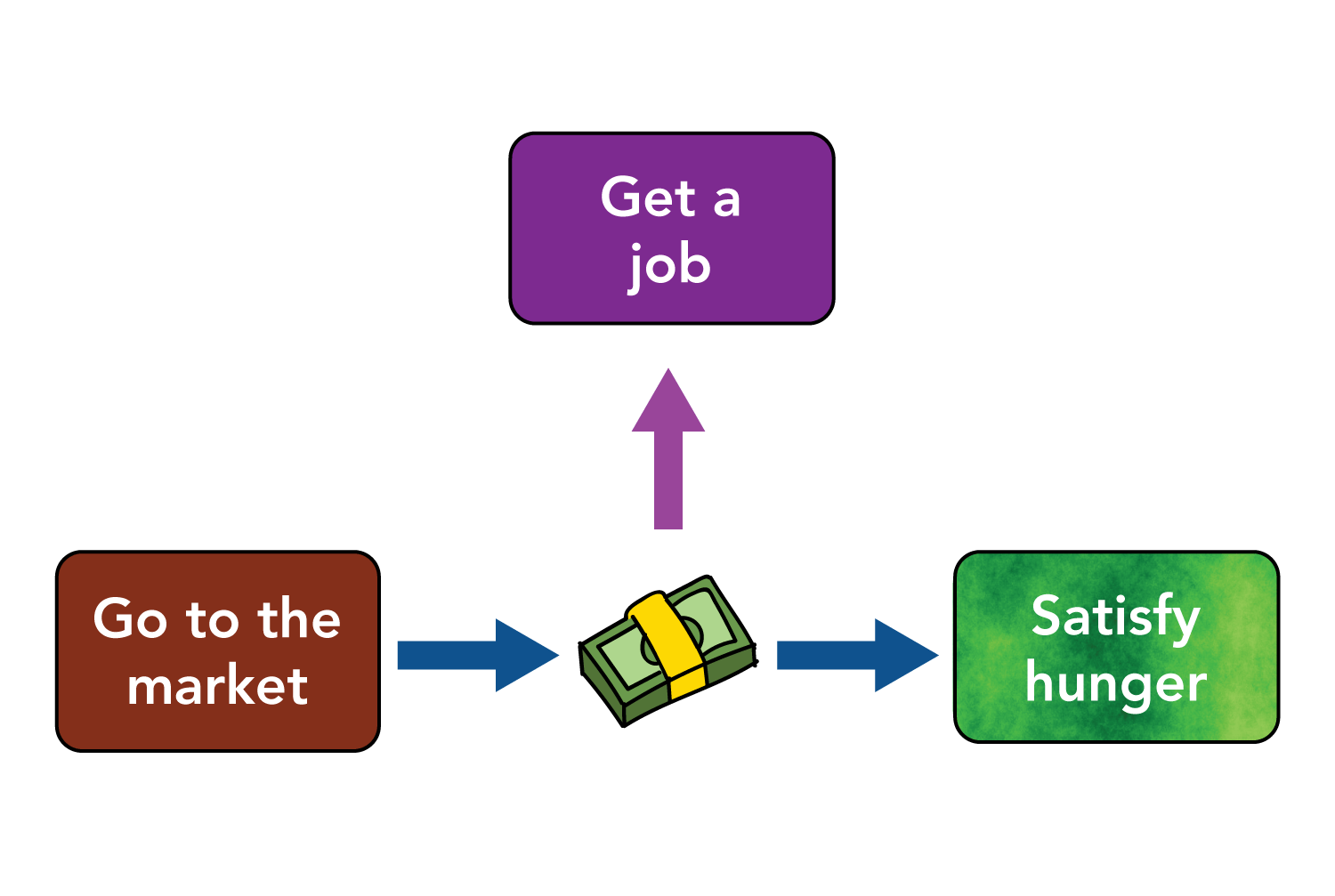

Well, in order to make money, Moe needs to have a job:

But then that introduces the question, “How does Moe get a job?”

Now a new end goal is introduced, which naturally lends itself to another mean. Well, in order for Moe to get that job, he needs to get an education.

But then of course you must ask, “How does Moe get that education?”

Well, he needs to enroll himself in school and choose what he wants to study.

Okay, so… how does he do that?

This question opens up a whole new chain of means and ends, all of which open up even more chains, which goes onward to perpetuity.

No matter how you view it, any introduction of money will create this type of infinite regress.

Why is this the case? What about money creates this interesting effect?

It all goes back to The Great Abstraction.

The Great Abstraction separated money from having any intrinsic value of its own, largely so money could capture value across an infinite range of desires. It needed to be formless so it could mold to any individual desire, while being universally transferable so the whole world could agree upon what it represented.

This created a puzzling paradox that we’re still trying to sort through today:

Money is a necessary part of every means, but it can never be an end in itself.

You know that interesting feeling you get when you have a bunch of cash left over from a recent trip abroad? The total disconnection you feel from the pieces of paper that were once valuable when you were in another land?

That’s what it’s like if money were an end in itself. It’s the realization that money is useless on its own; that its utility is determined solely by what it is able to do, and not what it is in its final form.

But confusingly, money is the only way to reach any goal we set for ourselves, so we must accumulate it as if it were the ultimate good. That’s the biggest mindfuck we all have to sort through.

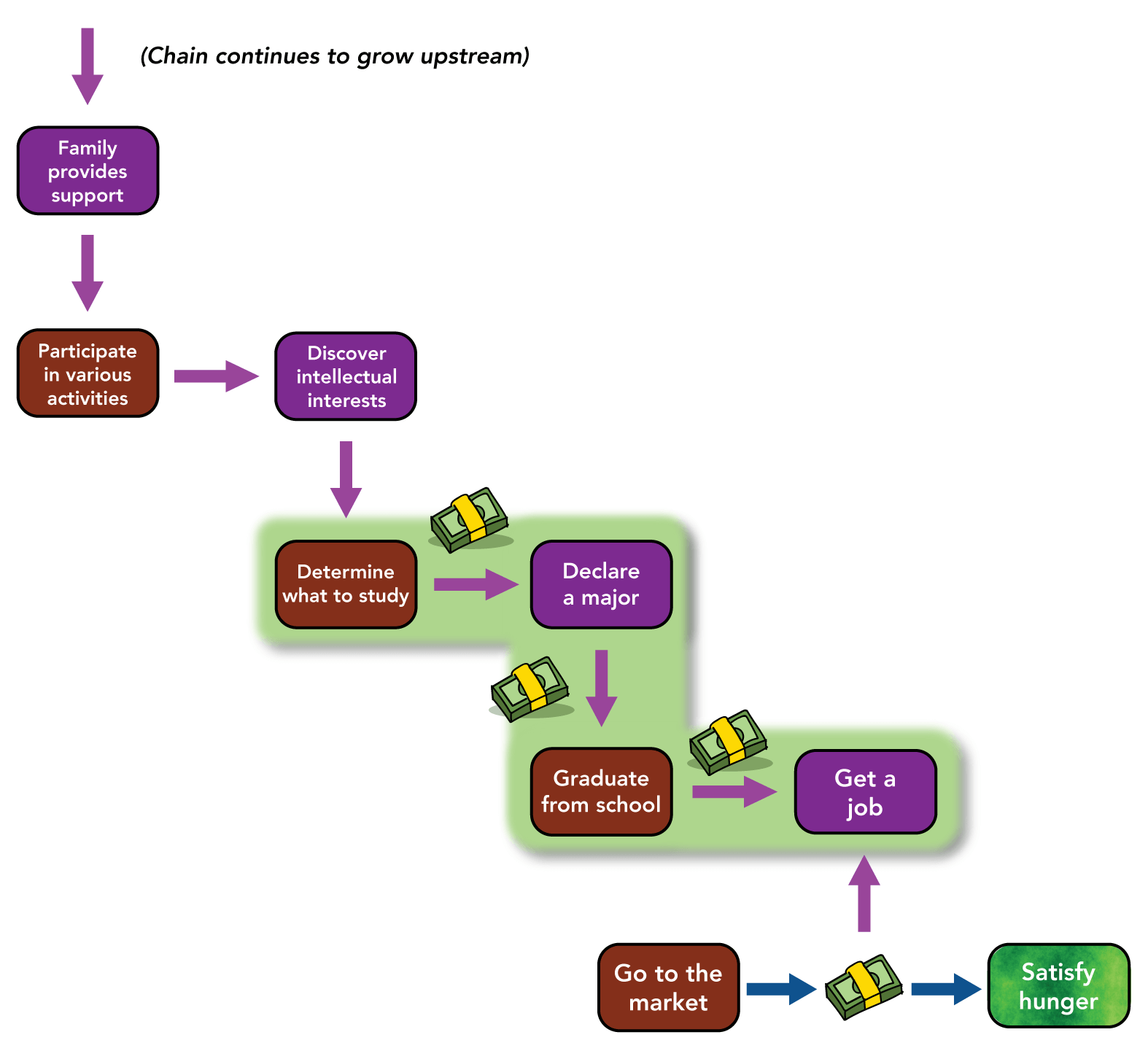

Let’s revisit Moe’s situation to illustrate this paradox:

When we look at Moe’s unending chain, we’ll see that money is not the final end. His final end is simple: he needs food so he can survive and stay alive.

However, in every chain that is birthed from that need to buy groceries, money is required for that new end as well.

In order for Moe to find a job, he needs to get an education, which requires money.

In order for him to determine what to study, he needs to experiment with various interests, which also costs money. Even if all he needs is an internet connection and a computer – well, that requires payment too.

Any attempt to guide him toward his interests has a monetary cost that either him or his family will have to support.

Money as the ultimate end is meaningless, but how do we reconcile this with the fact that we need it for everything?

This creates an abstraction so large that we often choose to ignore it altogether. Since money is needed for everything, we stop viewing our goals as independent ones, and instead aggregate them together in the form of an income. Individual goals matter less, while overall buying power matters more.

In Moe’s case, even though he just needs $10 to satisfy his hunger, that ability for him to make that $10 must invoke a never-ending process of monetary transactions that go well into the tens of thousands of dollars. Any individual goal with a monetary cost will require the satisfaction of many other price tags as well, so Moe will shift his attention away from any one goal, and toward earning an income instead.

With this move, we forever changed the nature of incentives. Instead of working to achieve particular goods or goals, we work for money.

This is not a critique of capitalism or any economic system; it is simply what has happened.

Money creates a process where the “ends” never end, as the satisfaction of each one gives rise to another. In a system where goals are endless (and where each one has a monetary cost), we will desire an aggregate sum over any individual need. An income is far more important than any one good.

This allowed money to collectivize every pursuit, as it became the universal way to satisfy the links in our means-to-ends chains.

This encouraged cooperation between people with fundamentally different belief systems. A Christian, Muslim, and atheist would find no problem working with each other to earn a living. A charity doesn’t care if you’re a Republican, Democrat, or Libertarian; they’ll take anyone’s money to further its cause.

As the world coalesced around the shared language of money, societies grew more efficient as incentives were aligned. People who had little in common were spending a third of their lives together to fulfill a shared goal. This large-scale collaboration powered the engine that would drive the path to modernity, one community at a time.

But the price of progress is rarely free, and in this case, the cost wasn’t paid by society at large.

It was paid at the most granular level through a disorienting process:

The complete dismantling of the self.

The Loss and Rebirth of Individuality

The general tendency . . . moves in the direction of making the individual more and more dependent upon the achievements of people, but less and less dependent upon the personalities that lie behind them.

-Georg Simmel

In mid-2019, Uber introduced a feature called “Quiet Mode,” where passengers would alert drivers that they didn’t want to be spoken to throughout the entire ride.

Reactions were mixed to this announcement. Some were relieved that there was finally a way to ask for silence without being rude about it. Others thought this feature was mean-spirited, that it dehumanized the driver to a mere instrument that takes you from Point A to Point B.

If philosopher Georg Simmel were alive today, he would have simply said that a feature like “Quiet Mode” was inevitable.

Over a century ago, Simmel wrote a book called The Philosophy of Money (published in 1900), where he was particularly interested in how a modernized economy would impact the nature of the individual. Specifically, he wondered how people would view their own role in a society where everything had a monetary cost.

He understood money’s ability to encourage large-scale cooperation, and that technology would only serve to accelerate it. Money unified people of diverse personalities in the pursuit of a common goal, which created engines of wealth in the form of corporations and entrepreneurs that delivered value.

Essentially, it is only through the shared story of money that a company like Uber could arise.

But the same force that allowed Uber to rise was the same thing that instructed its drivers to shut up during their rides.

Simmel believed that money would fuel incredible social progress, but would come at the cost of individual personality. After all, it’s not the driver’s unique demeanor that makes him valuable to Uber, it’s his mere possession of an operable car that does. Personality is secondary to the monetary value one can provide.

As Simmel puts it:

Money has provided us with the sole possibility for uniting people while excluding everything personal and specific.

Even though Uber is reliant upon their drivers in aggregate to fulfill their mission, no single driver will impact the company’s operations as a whole. In a way, this is just like money: while your entire net worth will help fulfill your goals, any one cent won’t have much impact on how you live your life.

At this point, you may feel a bit discouraged. In a world where we are all thrown into the bin of money, it’s easy to believe that we’re all destined to lose our individuality.

Perhaps we have no choice but to be viewed through the lens of dollar signs…

Well well, look who has something to say to that.

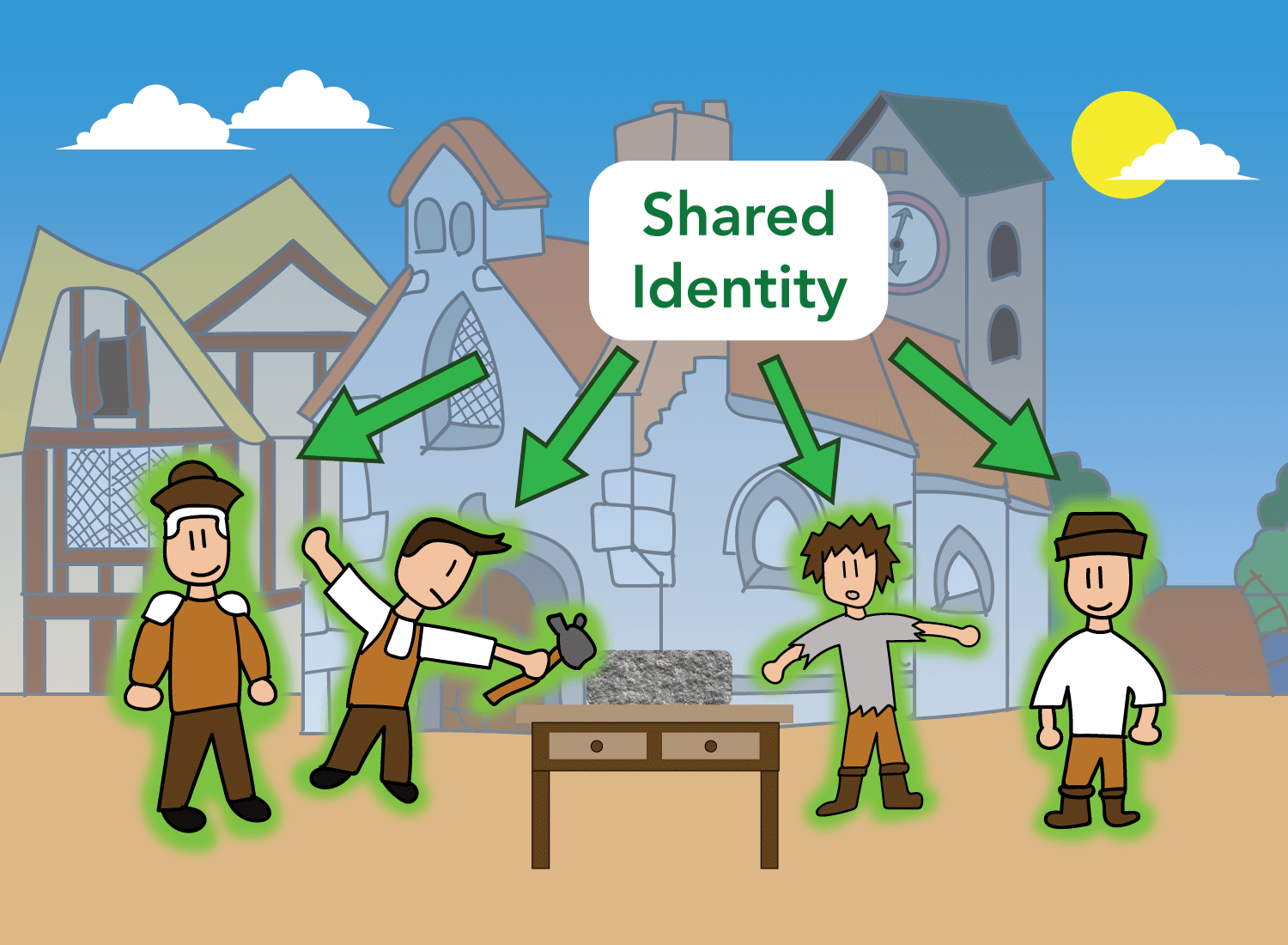

In one of Simmel’s most compelling ideas, he argues for why money has also allowed for the rebirth of individuality as well.

He believed that individuality arises when one has a diverse set of interests and communities. When you can spread your identity into a number of spaces, that reinforces the idea that only you can be the type of person that has this unique blend of interests.

Money makes this diversification process easy.

In the feudal days, if you wanted to be a part of a community (let’s say a medieval guild), that required you to be all-in. You had to live with the guild, only do business internally, have your family grow up within it – your life was primarily defined by your membership to it.

But in a modern society, membership to a community generally requires nothing more than money. Not much is demanded from the individual, just payment of some kind will suffice.

If you donate to a charity, you can say that you believe in a cause. If you purchase an online course, you are now a part of that curious tribe. If you pledge to your church, you are a member of its community, regardless of how many Sunday services you might miss.

Money enables you to spread yourself into as many areas as you’d like, fostering the idea of diversity as it relates to your identity.

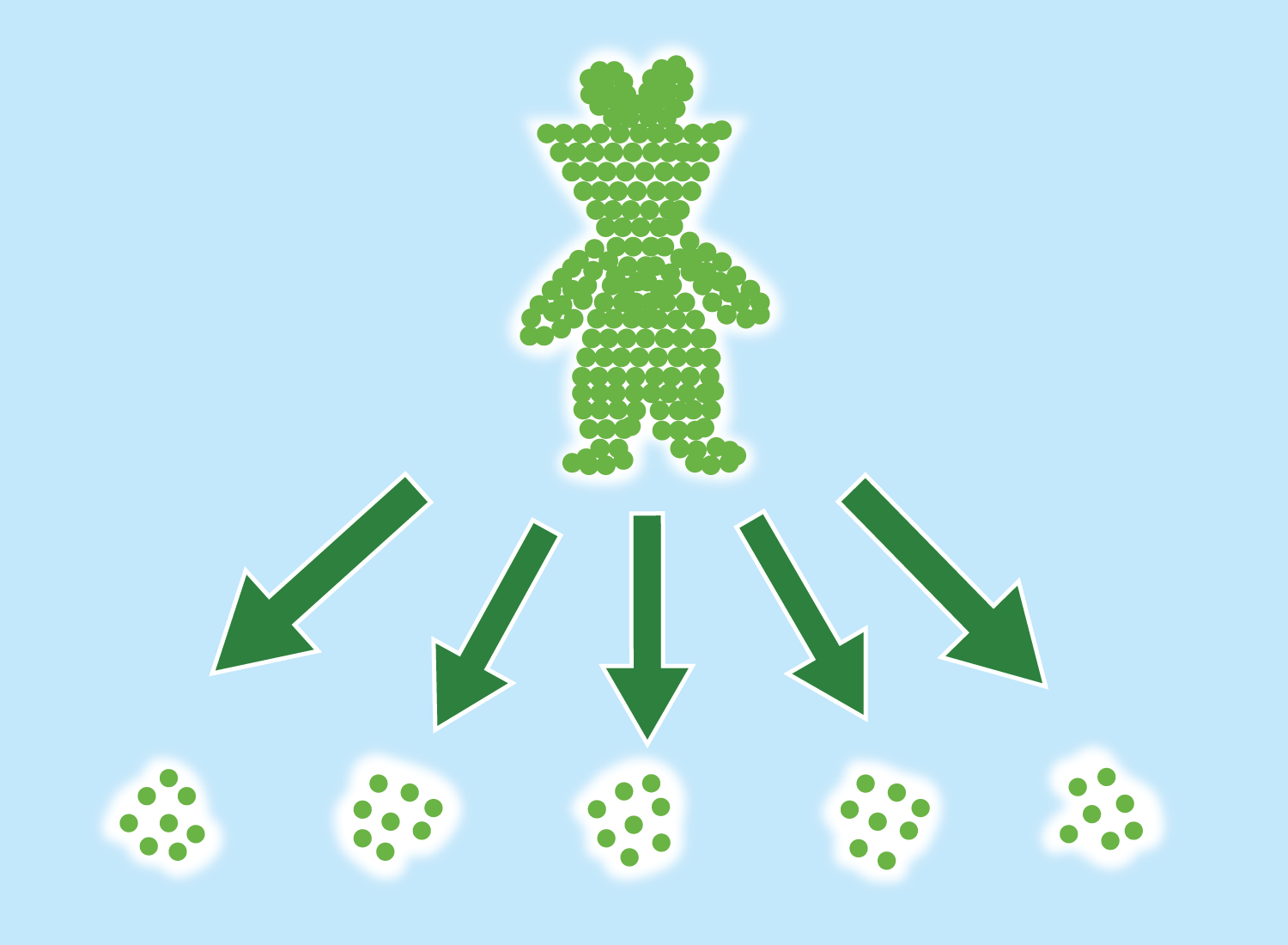

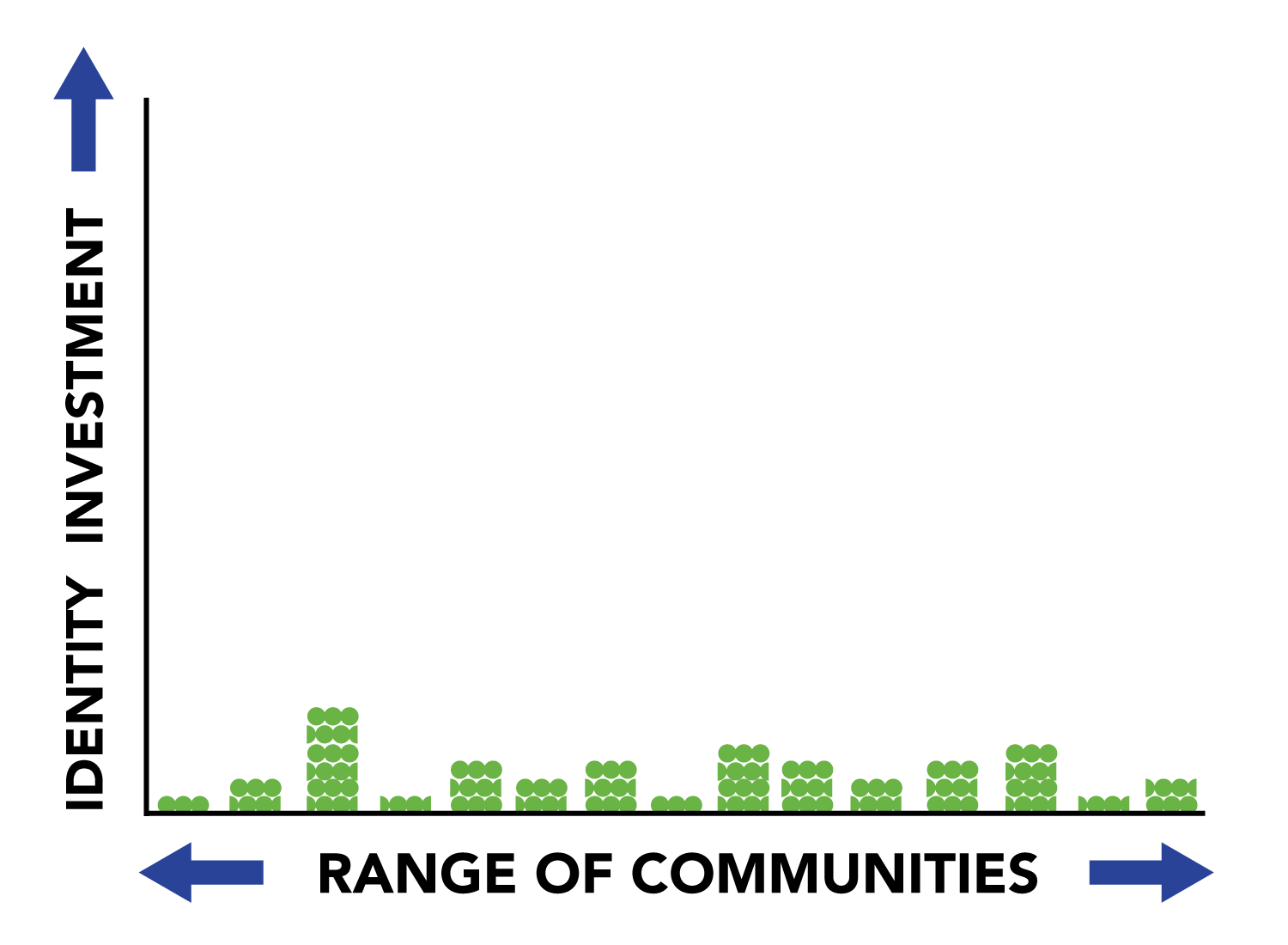

I like to think of this as the atomization of the individual. It’s the ability to break down one’s essence into small bits that can be distributed to any area of choice. And the easier it is to transfer money from one person to the next, the more communities one can join in the process.3

While this fosters individuality, there’s a problem that arises too.

Each social circle only gets a few atoms of people’s identities, which means that whole personalities can’t be cultivated in any one of them. Unlike a medieval guild, a community today requires minimal levels of commitment, so you will only have access to a small part of any one person’s life. The support one would get in an all-encompassing primitive society cannot be replicated today, as people are a part of many circles, but are not wholly devoted to one.

As a result, Simmel argues that identity crises naturally arise in modern societies. Since everyone is loosely involved in so many social circles (which grows as technology facilitates the transfer of money), they become unsure of what to prioritize, creating internal conflict in the process.

What if you’ve spent the last 20 years working as an accountant, but spending the last year in a ceramics studio is convincing you that this is your real calling? Or if you’ve been a Christian your whole life, but that science podcast you subscribe to is making you doubt your faith? Or your exposure to all kinds of people online is making you wonder if you really have much in common with the friends you have?

The multiplicity of social and cultural circles fosters individuality, but it can also make you feel alone in the decisions you must make. The type of support you’d get in an all-encompassing group like a guild gets increasingly rare with modernity, and we are often left to our own impulses to prioritize the order of our identities.

In this scenario, we usually make one of two choices.

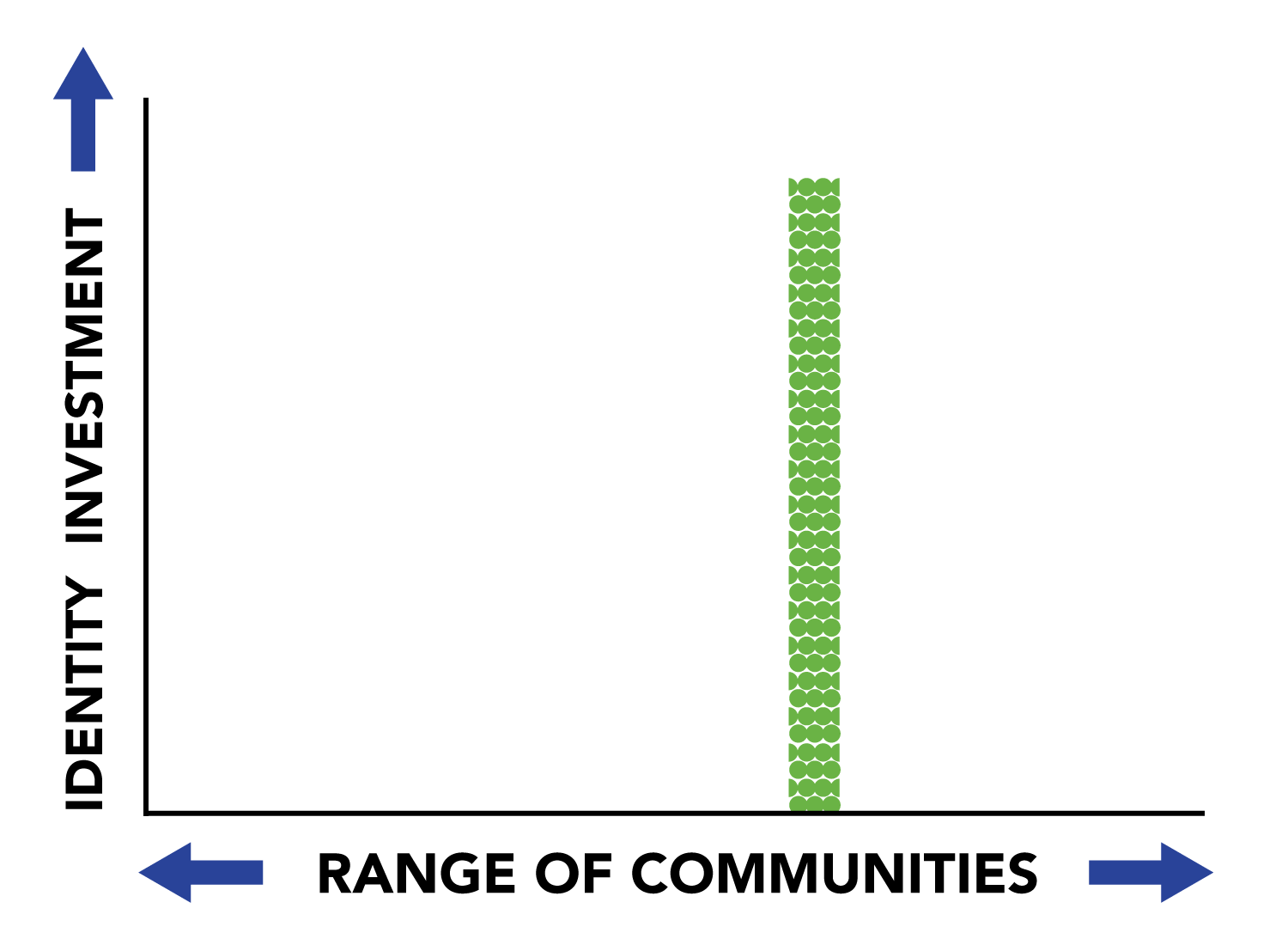

The first is to choose just one group, and focus all our energy and resources into that singular realm. I call this process the consolidation of identity:

This is what leads to the highly specialized fields we see in the modern world. In order to remove oneself from the internal conflicts created by endless possibilities, some choose to let only one area consume all their time. With all that energy going into that one field, it’s only inevitable that the knowledge in that area will become specialized and accessible by a select few.

Science is an example of this dynamic in action.

Biology, chemistry, and physics have been created as instruments for us to understand the world, but within each of these areas are fields of their own, of which those have more specialized subfields as well. As more people choose to absorb themselves into any one of these areas, these worlds become even more distinct and separate from one another.

An analytical chemist and a theoretical physicist may both adhere to the scientific method, but have knowledge so specialized that they would barely be able to explain their work to one another.

Modernity pushes us away from unification and into specialization. Bankers create debt instruments that seem like a foreign language. Philosophers use verbiage that only other academics can understand. Engineers build products that are akin to magic.

While specialization can foster progress, it can come with a sense of isolation. Going deep into any one thing removes you from all the other social and cultural circles you could be a part of, and that can be problematic for one’s individuality.

This leads us to the second choice one can make: the diversification of identity.

This is similar to the atomization concept, but in a way that is even more diffuse.

As a society trends out of scarcity and into one of abundance, Simmel states that a “tragedy of culture” begins to emerge. This is when you realize the sheer potential of what’s out there, but that you’ll never have the time or energy to master them all. It’s when you realize that you’ll never read all the books (even in just one subject of interest), visit all the places in the world, or meet all the people you find interesting.

It’s when you realize that your potential is constrained by the shelf life you’re born with.

In a desperate attempt to solve this problem, we tend to spread ourselves wide, hoping to do everything we can with the money we have. Buy a hundred books, even if we’re going to end up reading ten. Get all the clothes from each season, knowing that the closet can’t fit them all. Subscribe to all the streaming platforms, even if there’s only one show from each that’s watchable.

Materialism isn’t about the accumulation of goods. It’s about the fulfillment of possibilities.

When we desire a mansion, it’s not about the square footage it has, as we can only occupy a bit at once. It’s about the mere possibility of having all that space to access.

When we want a fast car, it’s not about the speed it can go, as you can only go so fast in traffic. It’s about the possibility of having a vehicle that could do special things.

A world of abundance continues to open new possibilities, which we will naturally seek to occupy in turn. It is this problem that can lead to pointless cycles of consumption, where the acquisition of one good leads to the recognition of yet another possibility.4 This is the problem we face as money is used to access these various realms.

But as is the case with any modern problem, there are pros and cons.

Money’s ability to provide easy access to social and cultural circles allows individuality to blossom. It is now rare to find someone that identifies themselves solely by their job or career. Chances are they’ll point to a confluence of religious affiliations, community groups, intellectual interests, familial roles, and so forth to describe who they are. Only they can occupy this unique set of possibilities at any given time.

But on the flip side, does this cause confusion in the individual? Is there an anxiety surrounding the fact that there are many roles to fulfill, and it’s unclear which is to be prioritized? Is money used as a crude way to solve for the fact that life is limited by nature?

There’s a delicate balance one must walk when money and individuality are tightly knit in this way. On one side is the recognition that money can help broaden your interests, and on the other is the belief that your interests are defined by how much money you have.

The difference may seem subtle, but one views money as a mere tool, and the other as the ultimate goal.

Slowing Down the Hamster Wheel

We’ve walked through quite a bit here, from money’s beginnings all the way to the reconstruction of the individual. Let’s zoom out and view the journey in its entirety below:

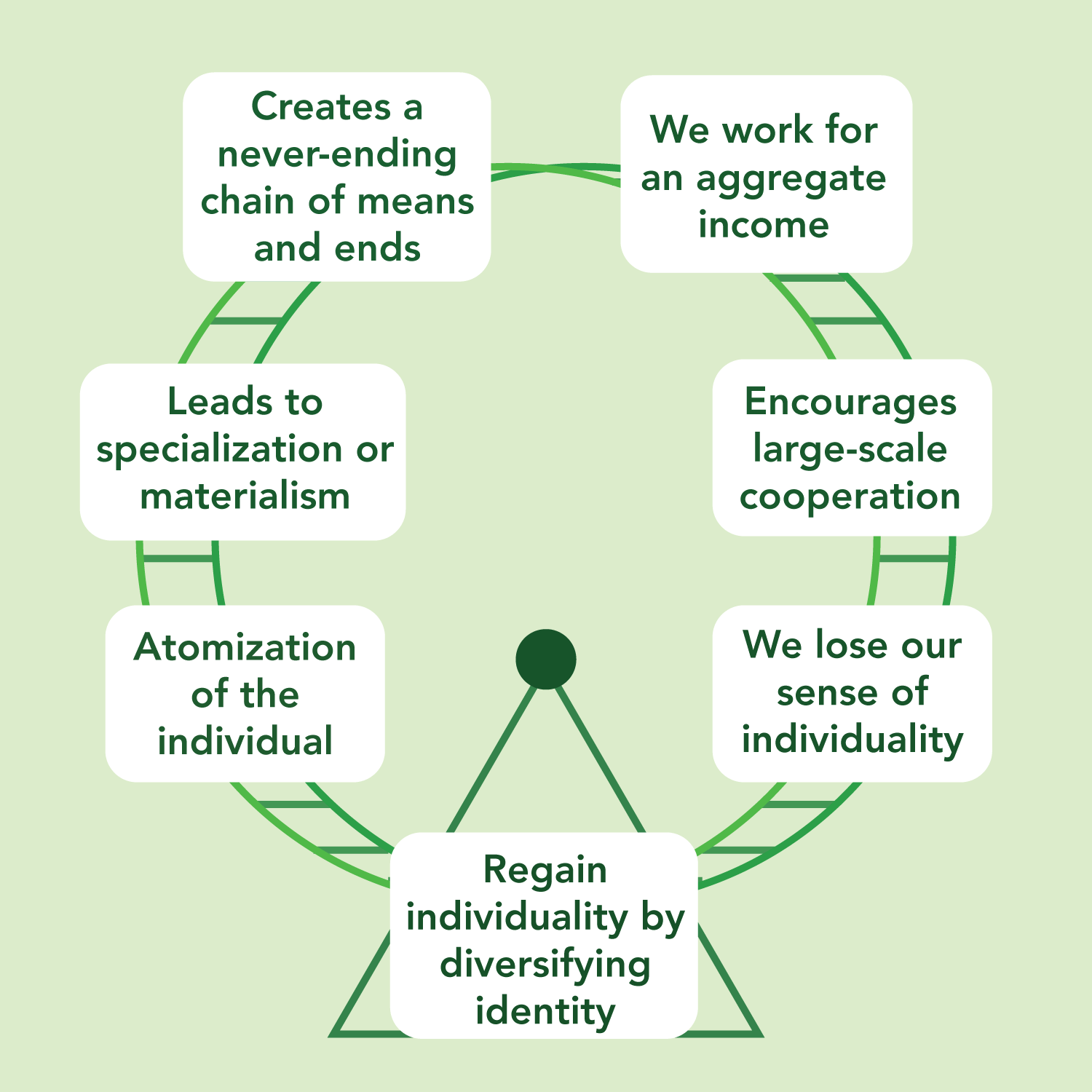

The Great Abstraction – or the separation of money from any tangible good – had an enormous effect on human behavior, which ultimately led to the latter half of the diagram. This part is what I call the Money Hamster Wheel.

When we say that money cannot buy happiness, this diagram explains each mechanism that leads to that insight.

The Money Hamster Wheel starts with the fact that money is required for every individual need we have. This causes us to aggregate our goals in the form of an income, which encourages cooperation, but comes at the expense of our individuality.

In order to solve this problem, we diversify our interests and embed ourselves into communities. But in the ultimate irony, money is the very thing that allows for that spread of identity as well.

We then either consolidate our identities via specialization, or we distribute them broadly to fulfill possibilities through materialism. In either case, money is a key ingredient, so we continue working for it.

However, since money has no intrinsic value, it can never be the final end. Despite this, we continue earning it to fulfill our individual goals.

And that puts us right back at the beginning again.

In a way, it’s simply not possible to get off the wheel. Even the most enlightened monks still have to depend on some source of money for food and shelter to survive.5 As much as I dislike the phrase, “It just is what it is,” money is one of those facts of life we simply must accept.

However, that which cannot be eliminated can be reduced.

When I look at each spoke on the wheel, I view them as potential opportunities to slow the whole thing down. If we are aware of each mechanism, we can notice when we’re operating under them, and lessen their impact in turn.

For example, let’s take the one about aggregating our goals in the form of an income.

While this has encouraged cooperation at a global scale, what has this mechanism done to the way we view one another?

One consequence of working for an income is that we start viewing things through the lens of calculable tradeoffs. Since everything – from food to healthcare – has a monetary cost, we view them as purchasing decisions that take away from our buying power. It becomes natural to view life through the lens of “If I give away x, then I’ll have y left over.”

This encourages rigid behavior, making us less spontaneous and more calculated. Our emotional capacities are dialed down as we justify our decisions in more numerical terms.

This imposes a limitation on how we view things like purpose and meaning, which cannot be validated in mathematical terms. So understanding this, it’s important to engage in individual pursuits that have no tie to an income or earnings potential.

Pursuits that are purposeful as ends in themselves.

Some people do this by volunteering for causes they believe in (not just donating to them), mastering a craft that brings them peace, or learning a trade simply to fulfill their curiosity. Regardless of the format, it’s important to engage in an endeavor that will deemphasize the allure of an aggregate income, which will help slow the Hamster Wheel down in turn.

Another spoke of interest is the atomization of the individual.

My biggest “a-ha” moment while reading Simmel was the realization that money gives us entrance into a plethora of social and cultural circles. This only grows with modernity, giving us unprecedented opportunities to build our sense of self.

The internet has only magnified this. With the advent of online platforms, communities, and games, we are called upon to join things that promise knowledge, entertainment, and a sense of belonging. But how much of this stuff do we actually need? Are we participating because it gives us real benefit, or is it another form of pointless materialism?

The more things we join, the more we spread our identity across a number of fields. While this promotes diversity, it also leads to emptiness. That’s what happens when you’re a small part of everything, but a whole part of none.

Today it’s important not just to cap material consumption, but to also hone in one’s individuality. To encourage us to go deeper, not wider.

It’s about realizing that the wide distribution of your identity doesn’t make you distinct and unique.

It just makes you conflicted and confused.

The power of each spoke can be lessened, but the Hamster Wheel must still remain. It’s about managing the speed in which it twirls, rather than stopping it altogether. As long as we need something to bridge the gap between reality and value, money will continue its reign.

Money is perhaps humanity’s greatest invention, the tool we created that ultimately became our governor. It forever changed human nature in every way possible. It forever changed the nature of work, the alignment of incentives, the identity of the individual, and the inner workings of every community out there.

We’d love to imagine a world without it, but at the same time, a world without it would be unimaginable.

Everything about money is a paradox in this way. Whatever is true on one side has an equally relevant truth on the opposite end.

Money has no intrinsic value of its own, but it is the universal determinant of value.

Money cannot buy happiness, but it buys the freedom required for happiness.

The able man must pursue money, but the dying man will regret that he ever did.

All perspectives are true.

Money is both the great everything and the great nothing.

This is what makes money the greatest question mark of our lives. When faced with a paradox like this, we tend to choose one side over the other, or ignore the whole problem altogether.

But if we take the time to look closer, we’ll see that a middle-ground exists. A place where our fears could be calmed, and our desires could be curtailed. A place where the quest for money falls only to what is essential.

In a world where neither scarcity nor abundance will do, perhaps the closest solution to the great paradox comes down to one principle:

The ability to recognize when we have enough.

_______________

_______________

Related Posts

Now that you understand the philosophy of money, here’s how you can refine your relationship with it:

Money Is the Megaphone of Identity

Control your Money Hamster Wheel, or else you might end up here:

The Riddle of the Well-Paying, Pointless Job

A reminder that the smallest identity atoms are what really matter:

The Small Things Are Big Windows Into Who You Are

_______________

Sources

Georg Simmel – The Philosophy of Money

David Auerbach’s fantastic series on Georg Simmel

Yuval Noah Harari – Sapiens (specifically the chapter, “The Scent of Money”)